One famous mantra in traditional and digital finance is investing in early-stage projects with massive potential for success. While the Winklevoss brothers, Micheal Saylor and Elon Musk, are testaments to the buy-low-sell-high sect, millions of investors have fallen prey to crypto rug pulls- promising projects with scammy founders.

Rug pulls have been a common theme in the crypto landscape, with the first being OneCoin in 2017. Its founder, Ruja Ignatova, vanished with $4 billion in investors’ funds. After this occurrence, every space - from NFTs, Metaverse, Wallet Naming Services, Yield Farming, Stablecoins, and Prediction Markets, has had one case of rug pull or another. This article delves into what constitutes a rug pull, its mechanics, notable instances, and how to spot and evade being a victim of such scenarios.

What is a Rug Pull?

A crypto rug pull is a scam where founders/developers pull the plug on a project after acquiring investors’ funds. The term paints a vivid picture—imagine the rug being pulled from under one’s feet, leading to a sudden and harsh fall. With rug pulls, investors move from high hopes to denial and finally guilt.

How Do Rug pulls Work?

The mechanics of a rug pull are pretty simple. Typically, developers (usually anonymous) create a new cryptocurrency or DeFi project, enticing investors with a novel crypto technology or the promise of high returns. They then take it a step further by using flashy websites and fabricated testimonials. As if this is not enough, adding a third spice of popular social media names for marketing buzz leaves an almost unquestionable allure for newbies who neither understand smart contract codes nor have the patience to study a project for red flags.

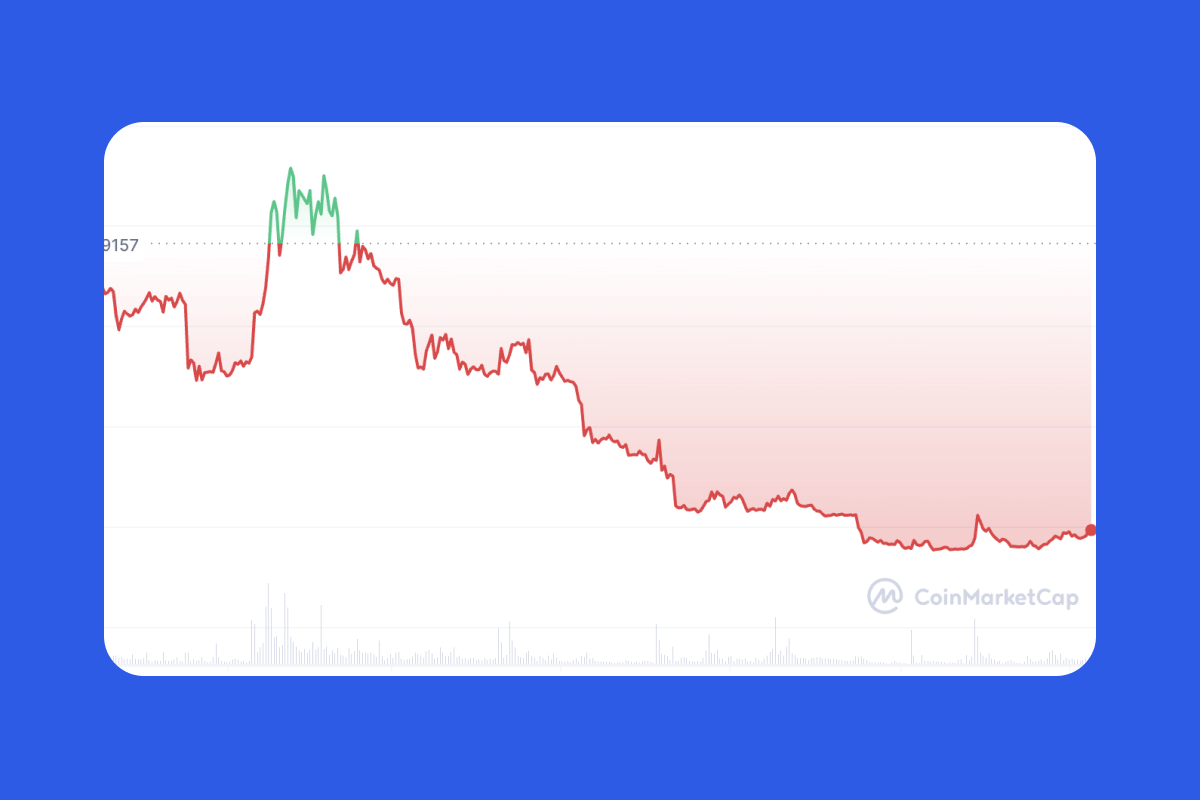

Once a substantial amount of money has been invested, the developers often drain all the funds from the project, disable the website, and vanish into thin air. The token price plummets to zero and investors are left holding bags (worthless digital assets).

Draining the funds occur in three common ways:

-

Dumping: Dumping is the most common form of rug pull. Here, the developers usually hold a substantial amount of the cryptocurrency and aggressively promote it on social media and using many celebrities. When there is significant price action, they then sell their holdings, thus driving the crypto price to near-zero. A recent example of this is the Squid Token scam. Founders/Developers selling a part of their holdings is nothing wrong in itself. Still, the question of how much token is being sold and how quickly it is sold differentiates usual crypto selling from dumping.

-

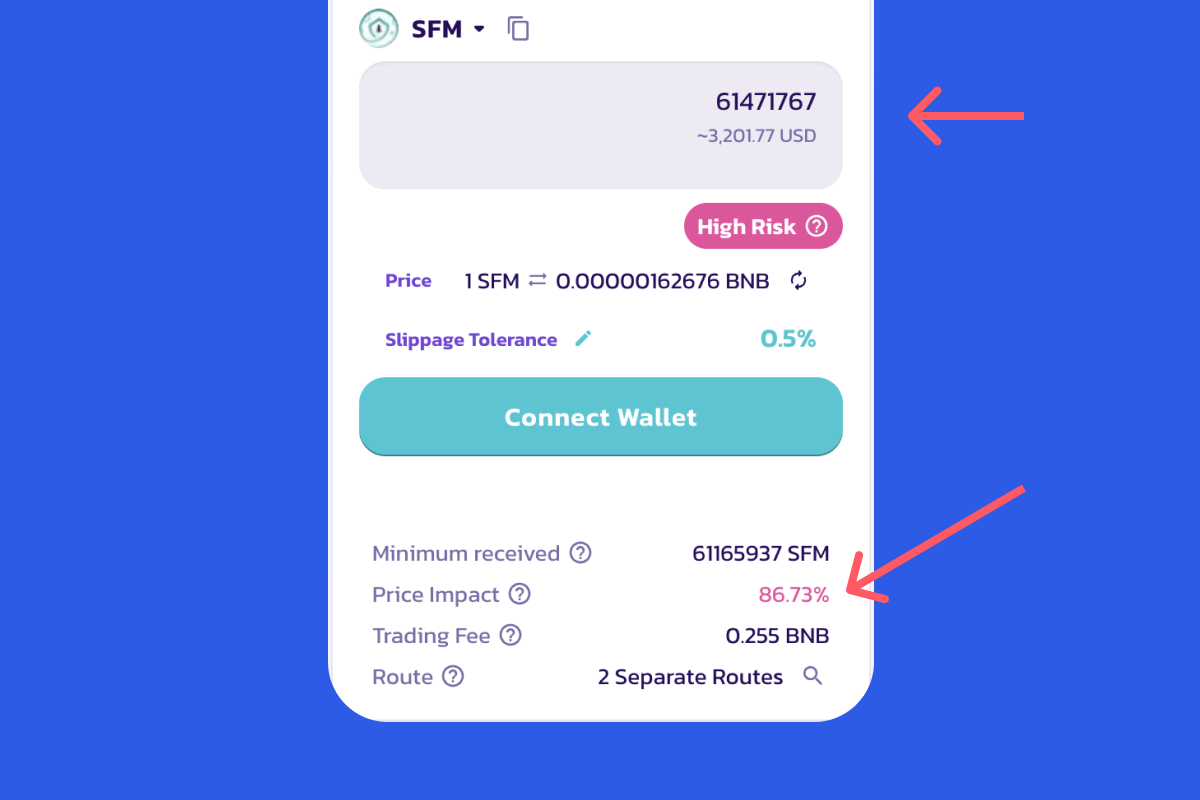

Liquidity Stealing: Liquidity stealing occurs when project owners withdraw all the coins from the liquidity pool. When a project’s token is paired against another in a pool, the founders can decide to sell the token, ultimately driving the price to zero. This majorly comes through a bug in the smart contract.

-

Limiting sell orders: Limiting sell orders is another subtle yet dangerous rugpull technique. In this scam, the smart contract is created in a detailed manner but with one caveat; Nobody can sell the cryptocurrencies except the developers. Again, this is very prevalent in new projects that are paired in a liquidity pool.

How to Spot Rug Pulls

Although scam actors are getting too schematic in their approach, there are still some tell-tale signs of a potential rug pull project. Some red flags include:

-

Anonymity: Be wary of projects where developers remain anonymous or have sketchy profiles. If a founder has questionable or no experience in the crypto space, you are almost sure to be rug-pulled.

-

Lack of Audits: Legitimate projects often have their smart contracts audited for security flaws, while rug pull projects typically do not. Although even some audited projects end up being rug pulls, your capital is still safer than in unaudited projects.

-

Unrealistic Promises: If a project’s propositions and projections seem too good to be true, it probably is.

-

Lack of Transparency: If you can’t pinpoint how the project can make money through its processes and without a continuous need for investors’ funds, you are most likely going to be rugpulled. How to Avoid Rug Pulls Steering clear of rug pulls requires a detailed and proactive approach. Although the list of things to check is exhaustive, and intuition is often the last guide, here are still some basic steps to consider:

-

Conduct Thorough Research: Delve into the project’s whitepaper, team, and community engagement. If it is too hard for you to understand or it doesn’t seem feasible, you are better off staying clear.

-

Seek Audited Projects: Opt for projects that have undergone security audits by reputable firms. This will go a long way in saving your funds from being rug-pulled.

-

Diversify Your Investments: Never put all your eggs in one basket; diversify to mitigate risks.

Crypto and Rug pulls: Opportunities and Peril

The crypto landscape is a minefield of endless opportunities and peril. As an investor, spotting rug pulls from afar would help you navigate this minefield safely and definitely keep you in the field for long. Arm yourself with knowledge, conduct diligent research, and remain cautious to secure your crypto against the harsh reality of rug pulls.