What Is THORChain?

THORChain is a decentralized cross-chain liquidity protocol that operates as an independent Layer 1 decentralized exchange (DEX) built on the Cosmos SDK. It uses the Tendermint consensus engine, Cosmos-SDK state machine, and GG20 Threshold Signature Scheme (TSS). THORChain enables users to swap native assets across multiple chains without requiring wrapped or pegged assets, maintaining transparent and fair prices without centralized third parties. It features continuous liquidity pools for maximum efficiency and manages funds directly in on-chain vaults.

How THORChain Swaps Assets Without Wrapped or Pegged Tokens?

Wrapped or pegged tokens are digital assets that represent another cryptocurrency on a different blockchain. They enable cross-chain transactions by ‘wrapping’ a native token into a compatible format for another blockchain. For example, Bitcoin can be wrapped as WBTC on the Ethereum network. This wrapping process involves locking the original asset and issuing a corresponding wrapped token on another blockchain, maintaining the same value. This method allows different blockchains to interact and exchange value, albeit often with reliance on intermediaries for the wrapping process.

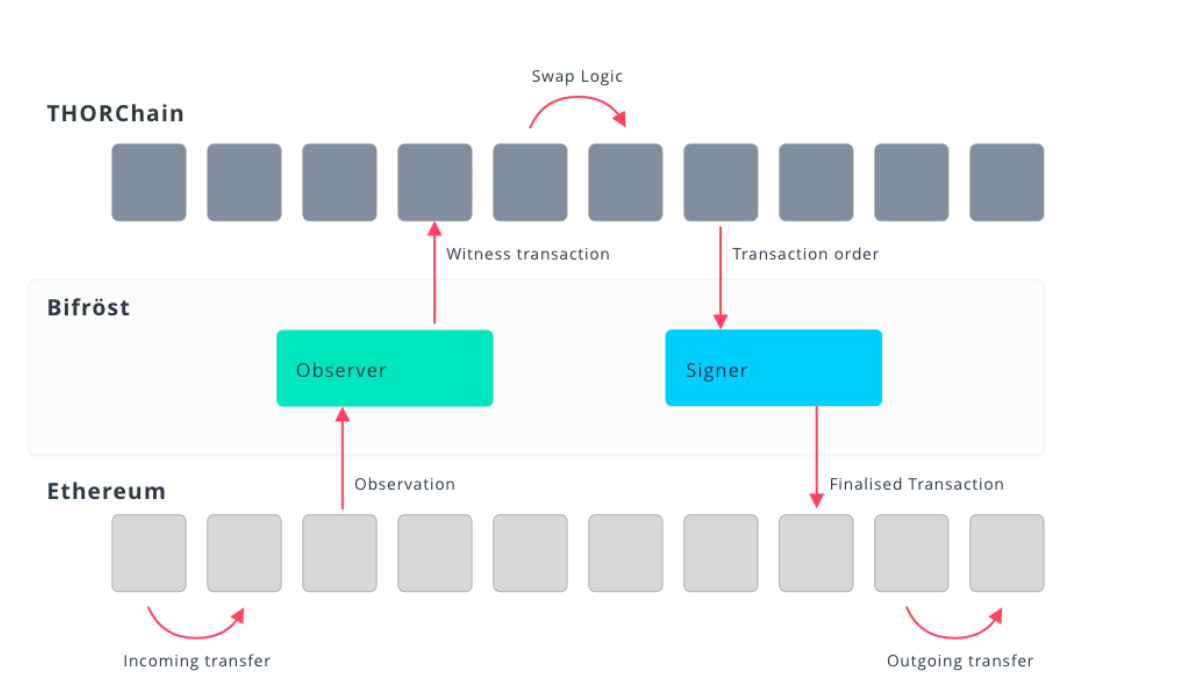

THORChain achieves cross-chain swaps without wrapped or pegged tokens through its Continuous Liquidity Pools (CLP). Each pool contains native assets of two different blockchains. When a user wants to swap, say BTC for BNB, they send BTC to the pool, which triggers the protocol to send an equivalent value of BNB from the pool to the user. This process is governed by an automated pricing mechanism and is executed on THORChain’s blockchain, ensuring that the swap remains decentralized and secure, while the native assets retain their original form on their respective blockchains.

How THORChain works. Source: docs.thorchain.org

How THORChain works. Source: docs.thorchain.org

Thorchain Key Metrics

-

Total Volume: $59.8B

-

Total Pool Earnings: $114.4M

-

Unique Swappers: 88.9K

-

Total Swap Count: 19.05M

-

Active Validators: 104

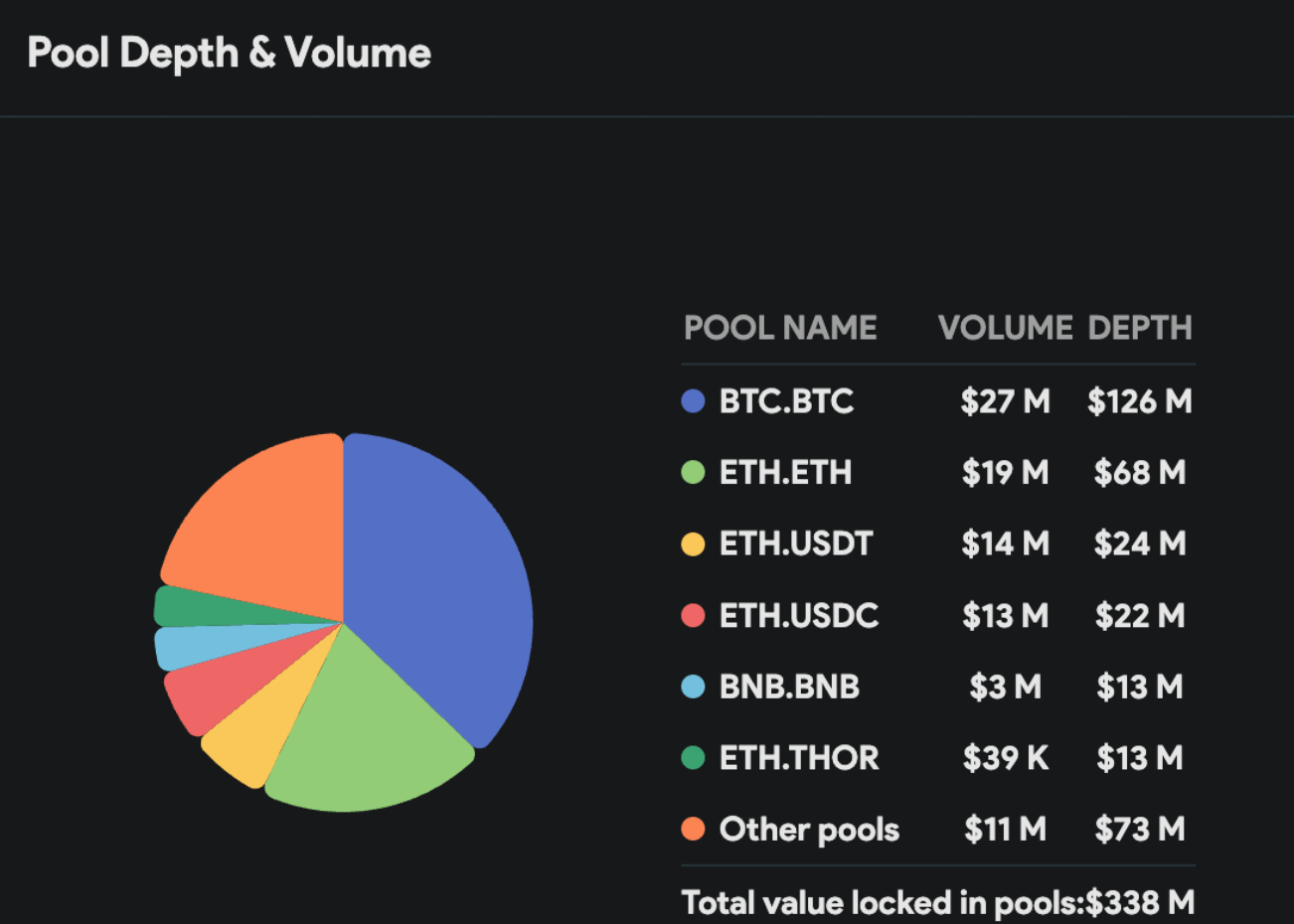

Total value locked in pools. Source: thorchain.net

Total value locked in pools. Source: thorchain.net

Tokenomics of RUNE

-

Hard Cap and Supply: RUNE has a hard cap of 500 million tokens. Currently, around 330 million tokens are in circulation.

-

Inflation Rate: The inflation rate of RUNE is calculated using the formula RESERVE/blocksPerYear/emissionCurve. With an active reserve of 100 million RUNE, the annual inflation is approximately 12.5 million RUNE, equating to an inflation rate of about 3.6% per year.

Uses of RUNE

-

Settlement Asset: RUNE is essential in liquidity pools, maintaining a 1:1 value ratio with other assets. This feature ensures efficient and balanced asset exchange.

-

Network Security: Node operators must bond twice the amount of RUNE than is pooled, securing the network and incentivizing responsible operation.

-

Governance: RUNE holders can influence the network’s direction by voting with their liquidity in specific pools, driving the activation of preferred pools.

-

Incentives and Liquidity Providing: Unlike traditional staking where one asset is staked, providing liquidity in THORChain, even asymmetrically with a single asset, automatically splits it into two equal parts: 50% the asset and 50% RUNE. This process ensures exposure to both assets. RUNE, central in this mechanism, is used for block rewards, distributed to liquidity providers, complementing swap fee earnings. To earn from assets on THORChain, it’s important to choose a RUNE wallet that supports liquidity providing functionality, distinct from conventional staking.