Cryptocurrencies, in their pioneering spirit, present us with the unique opportunity of becoming our own banks. But how do you self-custody your crypto? Let’s take a deep dive into this crucial aspect of crypto management.

The Essence of Crypto Self-Custody

To self-custody your crypto means to manage your own cryptocurrency assets. Instead of relying on third-party services, you control your own private keys, the crucial piece of information that allows you to access your crypto.

Why is Self-Custody Important?

When you take the reins of your crypto assets, you unlock numerous benefits:

-

Complete Control: The beauty of cryptocurrencies is in the freedom they provide. When you self-custody your crypto, you have full, direct control over your assets. There are no banking hours, no account freezes, and no limits to the number of transactions. Your assets are available to you 24/7.

-

Security: By holding your own private keys, you significantly minimize the risk of losing your crypto to third-party breaches. No matter how secure an exchange platform claims to be, they remain a high-value target for hackers. When you self-custody, you’re the only one who knows your private keys, dramatically reducing the risk of theft.

-

Privacy: One of the fundamental tenets of cryptocurrencies is privacy, which in the context of blockchain technology, is more accurately described as pseudonymity. When you self-custody your crypto, your transaction details aren’t shared with a third-party, like custodial services who require your KYC (Know Your Customer) details. While all transactions on a blockchain are public and can be traced, your real-world identity remains hidden, making your financial affairs pseudonymous.

-

No Trust Required: Trusting a third party with your assets can be risky. We’ve all heard horror stories of fraudulent services or exchanges going bankrupt. With self-custody, there’s no need for trust. The safety of your assets is entirely in your hands.

-

Proof of Ownership: When you hold your assets in an exchange, what you have is a claim on those assets, not the assets themselves. By holding your private keys, you have undeniable proof of ownership, meaning your cryptocurrency truly belongs to you.

How Do You Self-Custody Your Crypto?

Embarking on your journey to self-custodying your crypto might seem like a daunting task, but with the right steps, it’s quite straightforward. Here’s a detailed process of how you can self-custody your crypto:

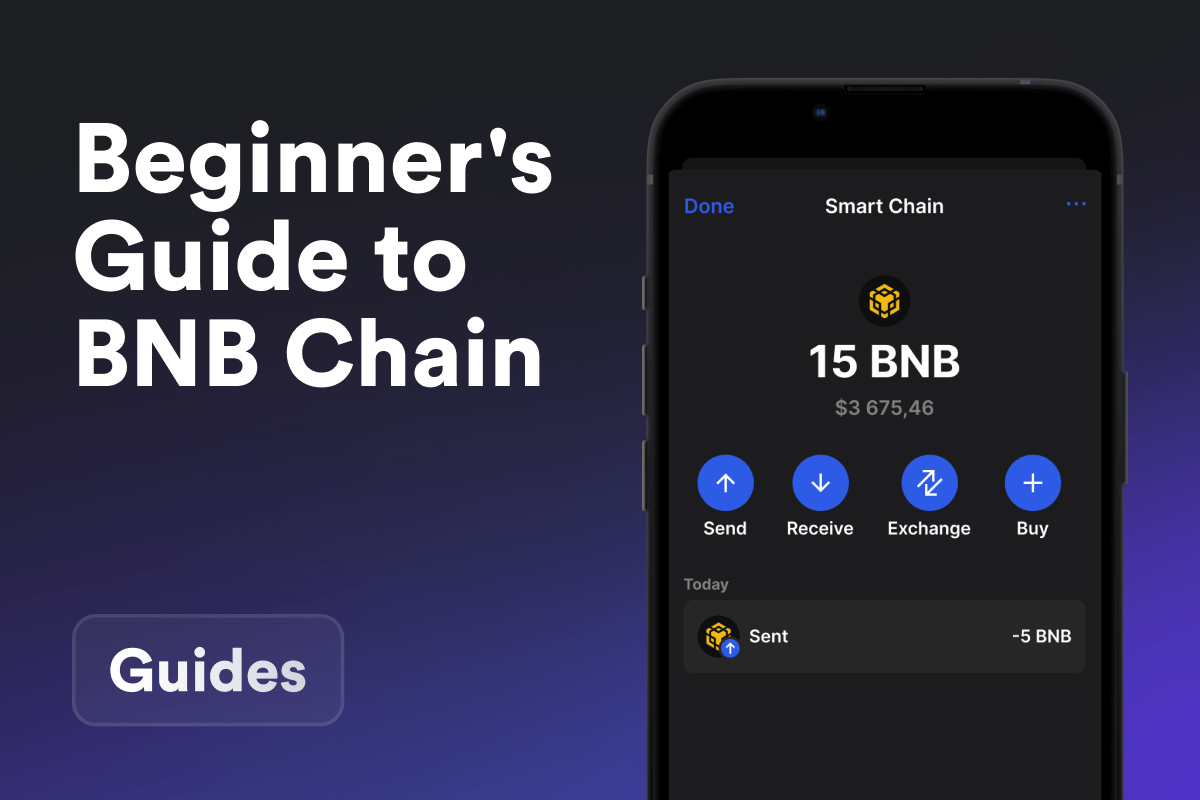

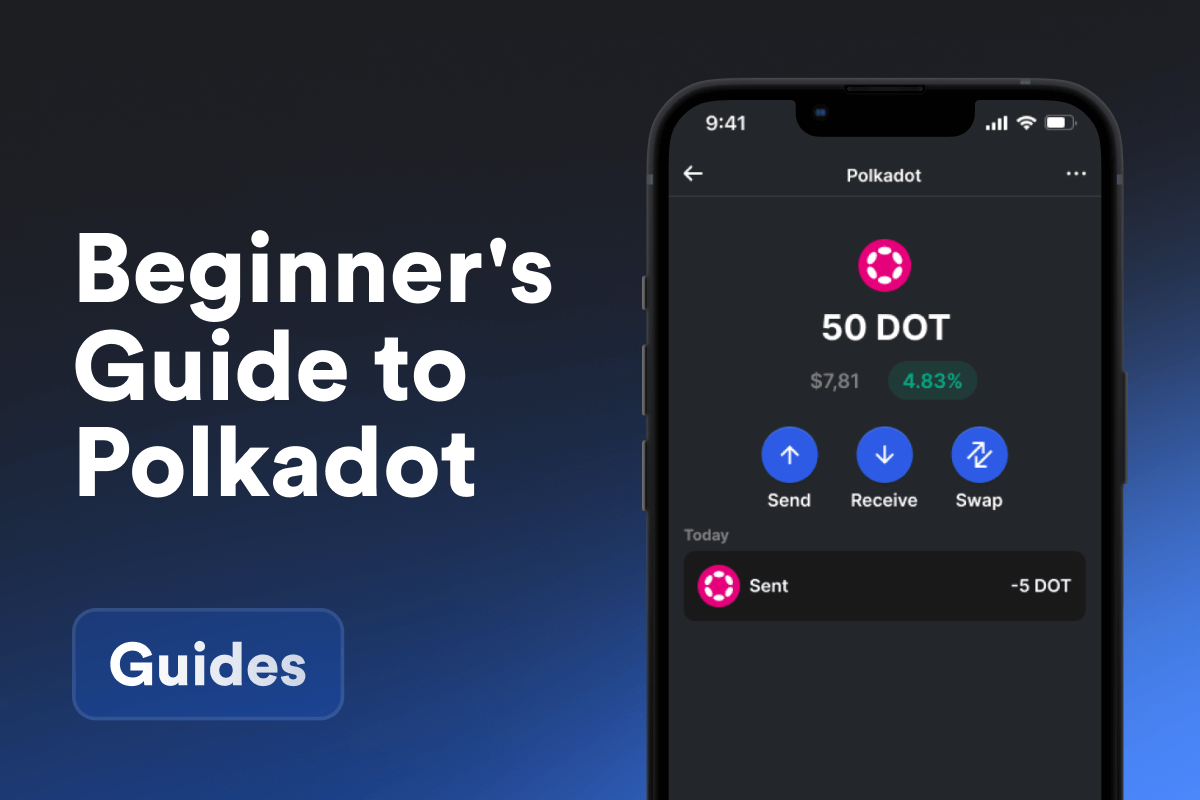

- Choose a Crypto Wallet: The first step in self-custodying your crypto is choosing the right crypto wallet. Wallets come in various forms, from mobile apps like [Gem Wallet]/download/ to hardware devices for large holdings. When selecting a wallet, consider factors like security features, user interface, supported cryptocurrencies, and customer support.

- Set Up the Wallet: After downloading or purchasing your wallet, you’ll need to set it up. This usually involves creating a password or PIN Code and backing up your seed phrase or recovery phrase. This phrase is a list of words that store all the information needed to recover your crypto assets. It’s crucial to keep this phrase safe, as losing it can result in a permanent loss of your assets.

- Transfer Your Crypto: After setting up your wallet, it’s time to transfer your crypto assets from your exchange account or another wallet to your new wallet. You can do this by sending the assets to your wallet’s public address. This process varies slightly depending on the wallet and the crypto asset, but it usually involves going to the ‘send’ or ‘withdraw’ section of your exchange account, entering your new wallet’s public address, and confirming the transaction.

- Verify Your Transaction: After sending the crypto to your new wallet, you should confirm that the transaction was successful. You can do this by checking your wallet’s balance. Most wallets update your balance automatically after a transaction is confirmed on the blockchain.

Remember, once you’ve transferred your assets to your own wallet, you’re solely responsible for their safety. Make sure to follow best practices for managing and securing your crypto.

This might all seem complex at first, but you’ll quickly get the hang of it. Embrace the learning curve – it’s part of the exciting world of crypto!

Securely Managing Your Crypto

Proper management of your crypto assets involves both routine security measures and awareness of potential threats. Here are a few best practices for securely managing your crypto:

- Secure Your Recovery Phrase: Your seed phrase or recovery phrase is like the master key to your crypto. If lost or stolen, your assets can be compromised. It’s vital to keep it safe and secure.

- Regularly Update Your Wallet App: Keeping your wallet application up-to-date ensures that you have the latest security enhancements and feature updates.

- Use Hardware Wallets for Large Holdings: If you have a significant amount of crypto, consider using a hardware wallet. These devices keep your private keys offline and safe from online threats.

- Beware of Phishing Attempts: Scammers might try to trick you into revealing your private keys or seed phrase. Remember, legitimate services will never ask you for these details.

Real-World Example: The Mt. Gox Exchange Hack

One of the most infamous events in crypto history is the Mt. Gox exchange hack. In 2014, Mt. Gox, which was handling approximately 70% of all Bitcoin transactions at the time, fell victim to a massive security breach. Approximately 740,000 Bitcoins (around 6% of all Bitcoin in existence then) were stolen from the exchange. To date, most of the stolen Bitcoins have never been recovered.

Customers who stored their Bitcoin in the Mt. Gox exchange had to endure a long legal battle to claim their lost assets, and many were never fully reimbursed. This incident underlines the risks of not self-custodying your crypto. Had the victims of the hack held their Bitcoin in their own wallets, their assets would’ve been safe from the Mt. Gox debacle.

Self-custodying your crypto might seem intimidating, but with the right knowledge and tools, it can be a walk in the park. Get started today with [Gem Wallet]/download/, and take control of your crypto!