What Is Injective Blockchain?

Injective Protocol, a leading layer-1 blockchain, is redefining DeFi with its Proof-of-Stake (PoS) architecture, offering unparalleled security and scalability. Catering to diverse DeFi needs, it facilitates a range of on-chain financial activities, including derivatives and futures trading. Its distinctive interoperability with major blockchains, like Ethereum, enables seamless cross-chain interactions, strengthening its position in the DeFi sphere.

Differences Between Injective and Other Blockchains

Standing apart in the blockchain realm, Injective is crafted using the Cosmos SDK and Tendermint PoS consensus, which grants immediate transaction finality.

-

Optimized for DeFi: Offers financial primitives like a decentralized order book for DApps development, enabling exchanges and prediction markets.

-

High Interoperability: Natively interoperable with various blockchains and IBC-enabled, supporting cross-chain transactions with Ethereum, CosmosHub, and others.

-

CosmWasm Support: Facilitates easy development of smart contract-based apps using CosmWasm, allowing migration from other CosmWasm-supported chains.

-

Token Compatibility: Supports Ethereum and IBC-enabled chain transactions, ensuring wide network exposure for tokens launched on Injective.

Key Features of the Injective Blockchain

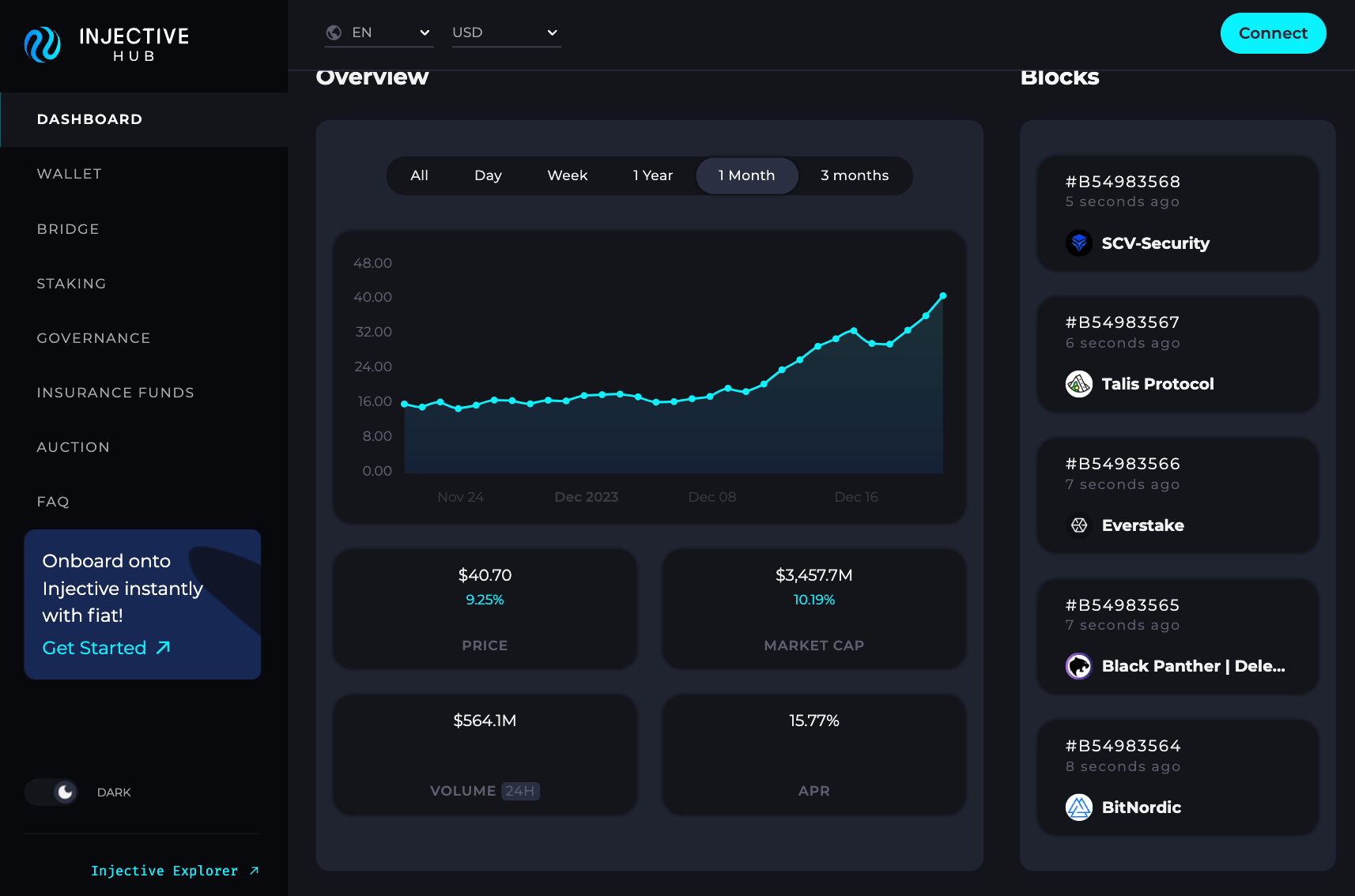

What Is the Injective Hub?

Injective Hub is a comprehensive DeFi platform on Injective, streamlining access to staking, governance, and wallets. It allows users to interact with various blockchain functions in one place, greatly simplifying the adoption and understanding of blockchain technology. This unified approach makes engaging with different aspects of the Injective ecosystem intuitive and user-friendly, enhancing the overall experience for community members.

Injective Hub: Interact with the Injective blockchain all in one place. Source: injectiveprotocol.com

Injective Hub: Interact with the Injective blockchain all in one place. Source: injectiveprotocol.com

What Is CosmWasm?

CosmWasm is a secure smart contracting platform written in Rust, designed for the Cosmos ecosystem and compatible with multiple blockchains. It’s a popular tool with over 850,000 downloads of its standard library and has been integrated into 90% of new Cosmos chains, showcasing its widespread adoption. Moreover, more than 30 layer-1 chains are utilizing CosmWasm, highlighting its significance in facilitating cross-chain interoperability and the development of decentralized applications (DApps) across various blockchain networks.

What Is Decentralized Order Book?

The order book on the Injective Blockchain is an innovative feature enabling direct, transparent matching of buy and sell orders. This system operates autonomously, without a central authority, thereby enhancing trade security and integrity. As a crucial element of Injective’s DeFi ecosystem, it supports fair and efficient trading of various financial instruments, like derivatives and futures, directly on the blockchain. This decentralized approach offers a stark contrast to traditional, centralized order books, providing a more open, trustless trading environment.

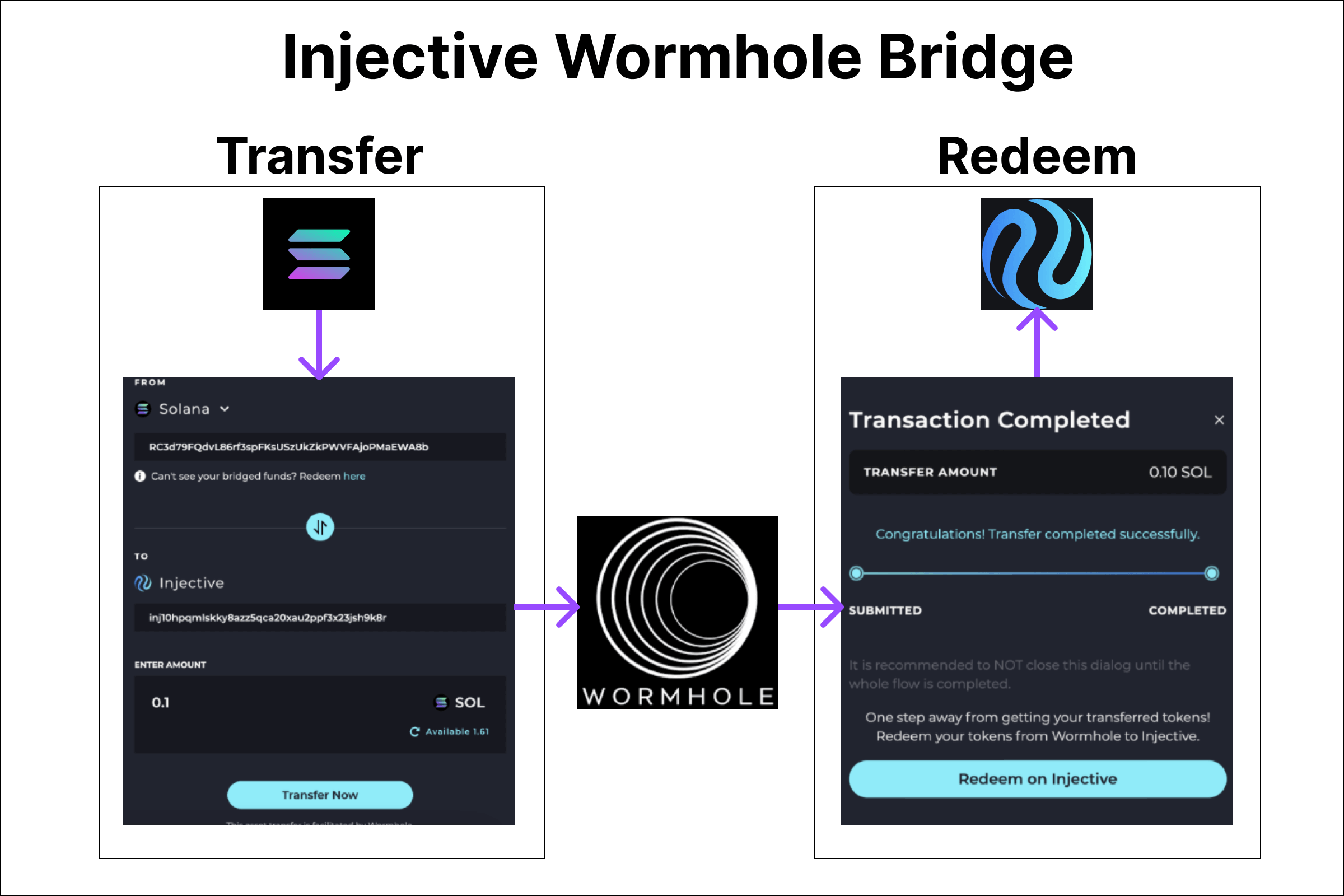

What Is Injective Wormhole Bridge?

The Injective Wormhole Bridge, a vital feature in the Injective ecosystem, supports the transfer of assets from and to various blockchain networks. Currently, it facilitates transactions with Ethereum, Cosmos IBC-enabled chains (such as Cosmos, Osmosis, Persistence, Evmos, Terra), Moonbeam, and others. This bridge enhances the platform’s interoperability, allowing users to efficiently and securely move assets across these diverse chains.

Wormhole Bridge: Transferring and redeeming assets across blockchains. Source: docs.injective.network

Wormhole Bridge: Transferring and redeeming assets across blockchains. Source: docs.injective.network

What Is Injective Insurance Funds?

Injective Protocol’s derivative markets are supported by dedicated insurance funds, crucial for limiting any socialized loss. Each market requires its own fund, and any user can create one or become an underwriter by contributing funds. The returns for underwriters depend on their ownership percentage in the fund, offering a balanced risk-reward dynamic within the Injective ecosystem.

INJ: Vital Core of Injective’s Ecosystem

The Injective token, known as INJ, is the native currency of the Injective blockchain, primarily used for covering network fees and transaction expenses within its ecosystem.

Tokenomics of INJ

-

Total Supply and Inflation: The initial total supply of INJ is 100 million tokens, which will increase over time due to block rewards. The target inflation rate at genesis is 7%, decreasing to 2% over time.

-

Deflationary Mechanism: The total supply of INJ may become lower than the initial supply, owing to a deflationary mechanism involving exchange fee value accrual.

60% of the exchange fees collected will be utilized in an on-chain buy-back-and-burn event. In this process, the accumulated exchange fees are auctioned off for INJ tokens, and the INJ received from this auction is subsequently burned, contributing to the deflation of the total INJ supply.

Uses of INJ Token

-

Transaction Fees: You will need INJ tokens for transactions on the Injective blockchain. This includes wallet-to-wallet transfers to friends, sending tokens from your wallet to exchanges, or executing smart contract transactions.

-

Staking: Another crucial role of the INJ token is to ensure the stability and security of the Injective network through participation in its Proof-of-Stake (PoS) mechanism. Users can stake their INJ tokens and receive rewards in return, contributing to the network’s overall health and security.

-

Governance Participation: INJ enables holder participation in network governance, influencing future developments.

-

Integration in DeFi Applications: INJ is used within Injective’s DeFi ecosystem, facilitating activities like trading and liquidity provision.