Blockchain, the tech behind Bitcoin and other cryptocurrencies, gained attention in 2009 when the Bitcoin whitepaper was released, coinciding with the Lehman Brothers collapse and the financial crisis. Blockchain is a straightforward concept at its core: chains of data blocks that continuously update after a group of people agree to new information. Beyond the scope of cryptocurrencies, it has found use in diverse areas like data storage and supply chain management. Moreover, it has paved the way for an exciting new use case in the world of finance known as Decentralized Finance (DeFi). Let’s delve deeper into this intriguing technology and its potential implications.

What is DeFi?

DeFi is short for decentralized finance, and it encompasses all forms of financial services accessible to users in the crypto space. From the name, decentralized finance refers to the absence of a central authority or institution overseeing financial services.

The shift from traditional finance, or TradFi, to decentralized finance, is primarily bolstered by the need to provide a peer-to-peer financial service framework without the need for a middleman. TradFi relies on intermediaries such as banks, brokers, and other institutions to transact. While this model has sustained money for decades, it comes with trade-offs in transaction charges, data leaks, and the enduring possibility of asset freezes or confiscation.

Decentralized finance eliminates that cost of trust by providing a service platform where users can transact in a peer-to-peer manner and access loads of financial services. For example, you can store money, borrow capital, or even earn considerable interest on your assets on your smartphone anywhere.

How DeFi works

To understand DeFi has a blockchain-powered financial service platform, it would be helpful to consider a platform such as iOS— Apple’s operating system.

Apple’s iOS is a software platform that brings together developers and users. Developers build numerous apps and services, including payment services such as PayPal, Zelle, etc., for users who then install these apps and utilize them for various (including financial needs).

Similarly, blockchains such as Ethereum allow blockchain developers to build valuable applications (decentralized applications or dApps) around cryptocurrencies for everyone to use freely. These decentralized applications, in turn, offer a wide range of services, with finance as a prime example.

What makes DeFi Distinct?

Decentralized financial services on blockchain platforms are distinct from conventional banking systems in several ways.

-

No middleman, no problem. Traditionally, payment apps tell you to deposit money into their platform with the option to withdraw or send to anyone later and probably earn some extra buck. While this typically holds true, it is worth mentioning that no line of code ensures this. Essentially making you depend on laws, regulations, and the honesty of the developers. Decentralized finance runs on a newer system called smart contracts. Smart contracts are lines of code that auto-execute when the contract terms have been fulfilled. For example, you can write a smart contract to send asset “A” to user “B” at a temperature “C” on day “D.” With smart contracts, you do not have to trust the party you’re transacting with; you need only look at lines of agreement written directly into the code.

-

Central Authority? No thanks! Whether digital or not, traditional financial systems are heavily controlled. JP Morgan has a chief body that can clamp down on operations; Apple owns iOS and can determine who builds apps on their platform. They can also remove apps at any time. Blockchain, on the other hand, is not under anyone’s control. No one determines what can be built or removed from the platform.

-

Please keep your KYC DeFi enables direct user interactions with DeFi wallets such as Gem Wallet. Without intermediaries holding user information, KYC procedures are not mandatory. This lack of KYC enhances privacy and user autonomy.

-

Borderless services DeFi services are location-agnostic. Users can access various financial instruments, lend, borrow, invest without being restricted by geographical boundaries. As a result, DeFi services are inclusive, accessible, and open to a global audience, fostering financial inclusion and innovation on a global scale.

-

Transparency Thanks to its foundation on blockchain, DeFi services are transparent. While only developers can access traditional payment systems’ code, anyone who cares to examine dApps can easily do so on the blockchain. Users can also scrutinize and verify the entire history of transactions, ensuring openness and accountability.

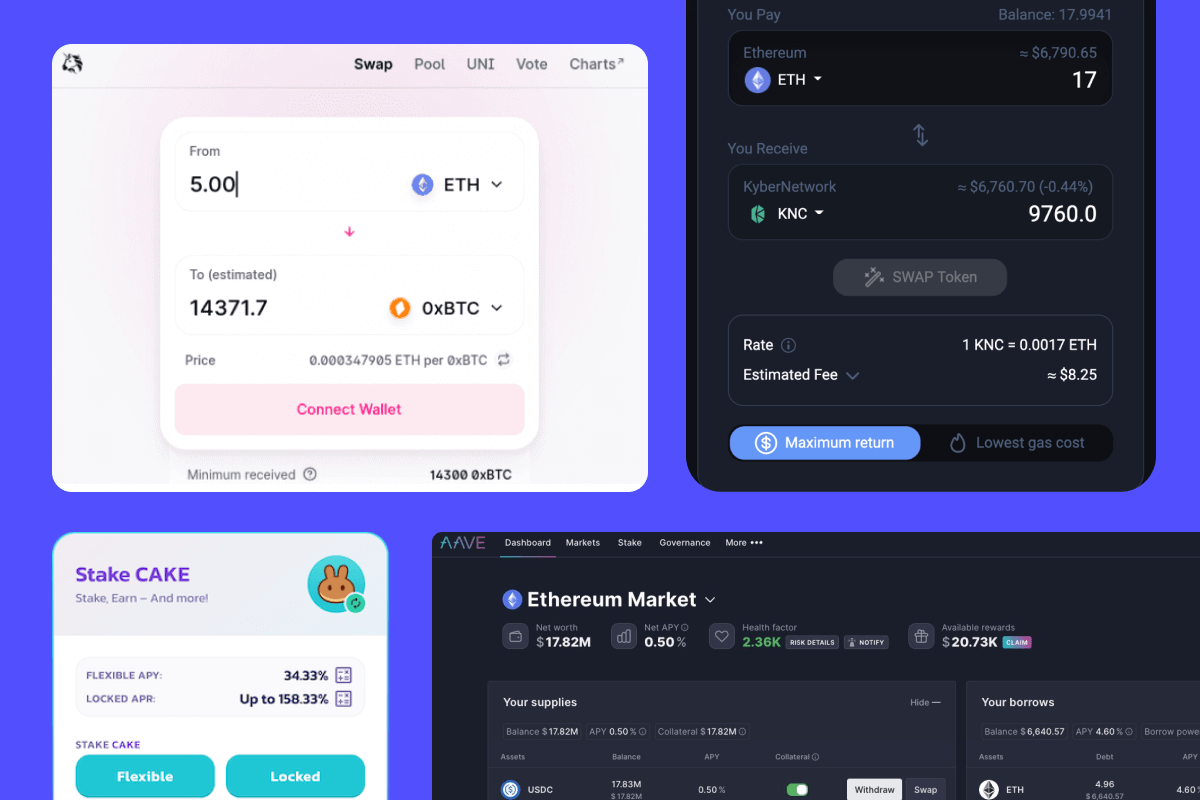

What DeFi Services Are Available?

DeFi expands blockchain use cases by introducing a diverse range of complex financial services, including:

-

Lending: DeFi platforms enable you to lend your cryptocurrency to others in exchange for earning interest on the borrowed amount.

-

Loans: You can borrow digital assets from the DeFi ecosystem by providing collateral, allowing access to liquidity without intermediaries.

-

Staking: Investors can participate in staking by locking up their cryptocurrencies to support network security and validate transactions while earning rewards.

-

Yield Farming: Yield farming involves providing liquidity to DeFi protocols and earning rewards in the form of additional tokens or interest.

-

Betting: Some DeFi platforms offer prediction markets or betting protocols where users can wager on future events or outcomes.

Challenges Facing DeFi Projects

-

Hacks and thefts: DeFi platforms are built on code, and vulnerabilities in smart contracts or decentralized applications may lead to hacking incidents and asset thefts. Security breaches can have severe consequences for users, as once transactions are recorded on the blockchain, they are irreversible.

-

High risk: DeFi protocols often involve complex financial mechanisms and are subject to significant market fluctuations. Users may face high levels of risk, especially when engaging in activities like yield farming or providing liquidity, which can lead to significant losses if not managed carefully.

-

Lack of government regulation: DeFi operates outside the realm of traditional financial systems, resulting in a lack of oversight from government authorities. While this provides greater freedom and accessibility, it also exposes users to potential risks and scams due to the absence of regulatory protections.

Conclusion

DeFi opens up a world of decentralized financial possibilities. It has redefined how we interact with money, introducing innovative services like lending, staking, and yield farming. While DeFi’s borderless nature and transparency offer immense potential, risks like the lack of regulation and potential security vulnerabilities demand cautious exploration. As the DeFi ecosystem evolves, staying informed and adopting responsible practices will be paramount to harnessing its true transformative power while navigating the challenges that lie ahead.