What Is Berachain?

Berachain is an innovative Layer 1 blockchain designed to enhance liquidity management and security within decentralized finance (DeFi) ecosystems. It originally started as an NFT project but has since evolved into a full-fledged blockchain network that supports Ethereum Virtual Machine (EVM) applications. At its core, Berachain uses a unique consensus mechanism called Proof of Liquidity (PoL), which plays a key role in the network’s operation.

What Is Proof-of-Liquidity (PoL)?

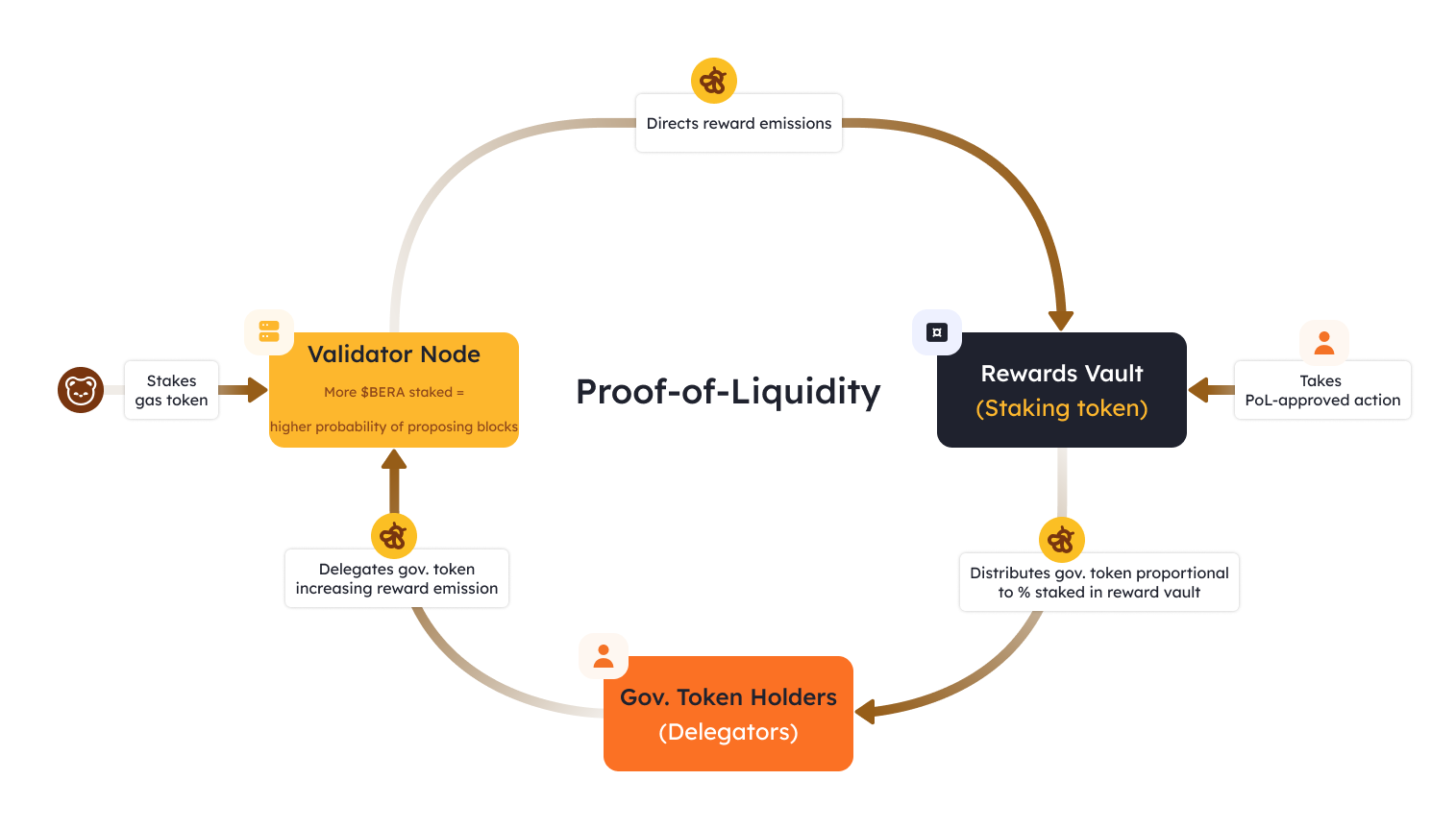

Proof-of-Liquidity (PoL) is a mechanism that combines network security with the active use of assets. Validators and liquidity providers don’t just stake tokens - they actively use them within the ecosystem. Assets remain available for trading on decentralized exchanges, are added to liquidity pools (shared reserves of tokens for automated swaps in DeFi applications), and at the same time, help maintain the security of the blockchain.

This model benefits all participants: the network remains liquid and secure, users earn rewards both from network validation and DeFi participation, and potential attacks on the blockchain become significantly more difficult. PoL is more than just a consensus mechanism - it enhances the overall efficiency and value of the ecosystem.

Proof-of-Liquidity (PoL) Mechanism in the Berachain Ecosystem. Source: docs.berachain.com

Proof-of-Liquidity (PoL) Mechanism in the Berachain Ecosystem. Source: docs.berachain.com

Key Differences Between Berachain and Other Blockchains

Berachain stands out from other blockchains thanks to its innovative structure and economic model. Here’s what makes it unique:

-

Consensus Mechanism: Instead of traditional models like Proof of Work (PoW) or Proof of Stake (PoS), Berachain uses Proof of Liquidity (PoL). This mechanism rewards users for providing liquidity rather than just holding tokens.

-

EVM Compatibility: Berachain is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to migrate decentralized applications (DApps) without modifying the code. This makes deployment easier and the ecosystem more accessible and user-friendly.

-

Cross-Chain Liquidity: Berachain allows assets from different blockchains to interact within a single, flexible DeFi ecosystem. Users can efficiently combine liquidity from various sources. For example, swaps between Ethereum and Berachain can be made without the need for complex bridges or intermediaries.

-

Modular Architecture: Built on Cosmos SDK and utilizing BeaconKit, Berachain is highly modular. This approach allows developers to easily customize the blockchain for specific use cases, improving its scalability and flexibility.

Berachain Tokenomics: The Tri-Token Model

To support the network’s economy and the PoL mechanism, Berachain operates with three key tokens.

BERA

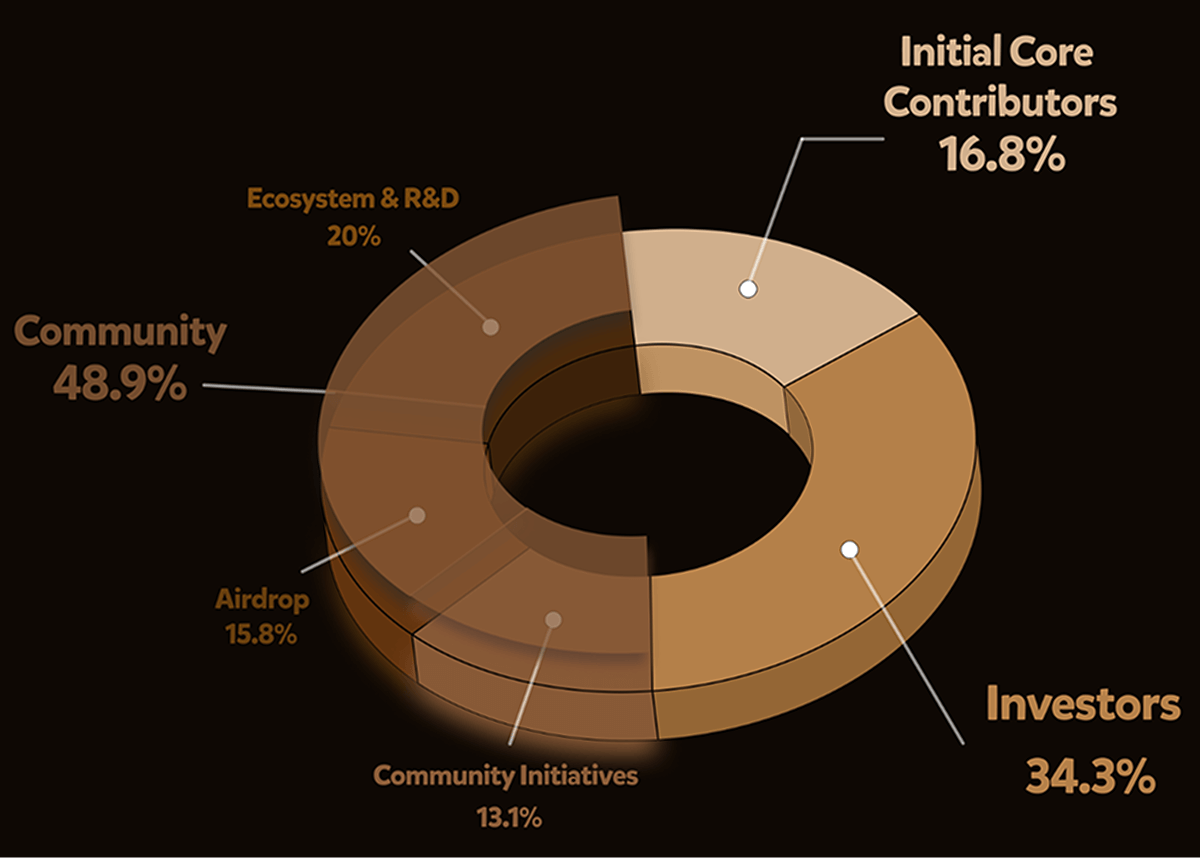

Bera is the native utility token of Berachain, used for paying transaction fees, similar to how ETH works on Ethereum. BERA holders can also earn governance rights by staking their tokens in reward vaults. The total supply is 500 million BERA, with an annual inflation rate of around 10%. Token distribution happens gradually - in the first year, 1/6 of the total supply is unlocked, while the remaining tokens are released over the next two years.

BERA Token Allocation. Source: docs.berachain.com

BERA Token Allocation. Source: docs.berachain.com

BGT (Berachain Governance Token)

BGT is a governance token that cannot be transferred or sold. It is earned by users who provide liquidity or participate in other activities and is used for voting on key decisions in the Berachain ecosystem.

Holders can delegate their voting rights to another address, stake BGT with validators to increase rewards, and exchange it for BERA at a 1:1 ratio. However, the exchange is one-way only - once converted to BERA, BGT cannot be restored, making it essential for network participation and reward distribution.

HONEY

HONEY is the native stablecoin of the Berachain network, softly pegged to the US dollar. According to the project, its initial collateral will include USDC and PYUSD, while new assets for minting HONEY will be decided through project governance. HONEY helps keep the ecosystem stable and serves as a reliable exchange medium for users, playing a role in lending, trading, and other DeFi activities.

The three-token model of Berachain solves the issue of rising fees seen in blockchains where a single token is used for both staking and gas payments. In Berachain, BERA and BGT are separate, meaning staked assets do not reduce the liquidity available for transactions. This allows users to contribute to network security without increasing transaction costs.

Use Cases of Berachain Blockchain

Berachain is used in different areas, from finance to gaming and digital assets. Let’s take a look at its main applications.

DeFi and Liquidity: The network supports decentralized financial services, including trading, lending, and providing liquidity.

Staking and Governance: Users can stake BERA to receive BGT, which is used for voting and boosting rewards.

NFTs and Digital Assets: Creators and collectors can mint and trade NFTs. Low fees and fast transactions make Berachain a convenient platform for digital assets.

Gaming and Metaverse: Berachain supports gaming projects where players can own, trade, and earn rewards from in-game assets.

Payments and Business: HONEY can be used for purchases, international transfers, and business transactions.

Berachain combines convenience, speed, and versatility, making blockchain technology accessible to both users and developers.