Blockchain and Cryptocurrency are top among the buzzwords on the internet, echoed by every social media outlet and mainstream corporation; blockchain technology and cryptocurrencies have become prominent players in the ever-evolving landscape of finance and technology. But what do these words really mean? We will delve into the origins of blockchain, its practical implementation, and the distinctive features that set cryptocurrencies apart from traditional fiat currencies.

What is Blockchain — How does the Blockchain technology work?

Imagine cubes (blocks) with unique identifiers strung along a never-ending metallic chain, where more cubes can be added to the end of the chain up to infinity, but only when the preceding cube has been verified to have been complete and correctly added. The blockchain works via a similar process. However, this happens on the internet using the computing power of several computers called nodes to ensure that adding a new block is error-free and adequately verified.

The term decentralized Blockchain or Blockchain Technology is largely believed to have been conceptualized by the unknown person(s) using the pseudonym of Satoshi Nakamoto in 2008, in a whitepaper establishing the basis for the first blockchain model for the first ever publicly transacted online cash currency — Bitcoin. More on this later. As much as the practical concept of blockchain technology is accrued to Satoshi’s 2008 Bitcoin paper, further history reveals that the first description of the native mechanism of the blockchain was first described by two researchers, Stuart Haber, and Scott Stornetta, in 1991.

Essentially, a blockchain is a decentralized, distributed, and public digital ledger used to record transactions across many computers so that the record cannot be changed retrospectively without affecting all subsequent blocks and requiring network consensus for such changes. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. The blockchain is an immutable ledger that can be used to track transaction records or assets arranged in blocks on a network of connected computers (nodes) — The blockchain network. The use of the blockchain, especially in finance, has increased exponentially over the years, tracking a wide range of transaction records and assets such as Non-fungible tokens (NFTs) and Cryptocurrencies.

What is Cryptocurrency?

The idea of a currency is not strange; it is a recognized medium of exchange for products and services. As a matter of fact, the use of a material as a means of exchange is as old as man himself, from the barter system to the current fiat currency system, which is believed to have taken shape during the 17th and 18th centuries, as governments started to establish central banks and formalize their monetary systems. Also, as industrialization and globalization progressed, many countries adopted the centralized system of fiat currency as we now know it today.

Bitcoin is the first cryptocurrency ever made after implementing the Bitcoin blockchain technology in 2009 — a year after its original white paper was released and it is by far the most popular. Usually, cryptocurrencies are made through a Cryptocurrency mining (or minting) process, which essentially describes a process whereby individuals tagged “miners” use specialized computers to attempt to solve some complex mathematical problem on the blockchain, and the first to get this problem solved gets a specified value of the cryptocurrency and a chance to add a new block of transaction records to the blockchain. The cryptocurrency mining process essentially describes how new cryptocurrencies are made, but it also serves other essential functions like ensuring the security and decentralization of the blockchain network.

Cryptocurrency, like fiat money, is also a type of currency, and keeping the things we know about fiat currency, cryptocurrency can also be used as a means of exchange for products and services. The first purchase with Bitcoin was that of Laszlo Hanyecz, a programmer who bought 2 large pizzas with 10,000 Bitcoin on May 22, 2010. As of 2023, this meal is worth millions of US dollars and is still celebrated as “Bitcoin Pizza Day” every year.

Nevertheless, cryptocurrencies have unique features that set them apart from fiat currencies. Some of these features are listed below:

- Form: Cryptocurrency is a digital or virtual currency; hence it can not be spent in a physical or tangible form. There are no physical representations of cryptocurrency

- Issuance: unlike fiat currencies issued by the government and central banks, cryptocurrencies are created through mining or minting.

- Backing: fiat currencies are usually backed by the government’s trust and the economy, while cryptocurrencies are not traditionally supported by physical commodities; the value is determined by demand and supply.

- Security: the security of fiat currencies is ensured by centralized institutions, while cryptocurrencies are secured through cryptographic algorithms and blockchain protocols.

- Value stability: fiat currencies are relatively stable. However, their value is also affected by inflation and other economic factors, while cryptocurrencies’ values are highly volatile and subject to market demand and sometimes sentiment. However, It is important to note that both fiat currency and cryptocurrency have their strengths and weaknesses, and their real-world use cases may differ significantly.

Why the popularity now?

The comprehensive media coverage and mainstream adoption synergistically are some of the main reasons for the exponential popularity of cryptocurrencies and blockchain technology. Still, these are with good reasons.

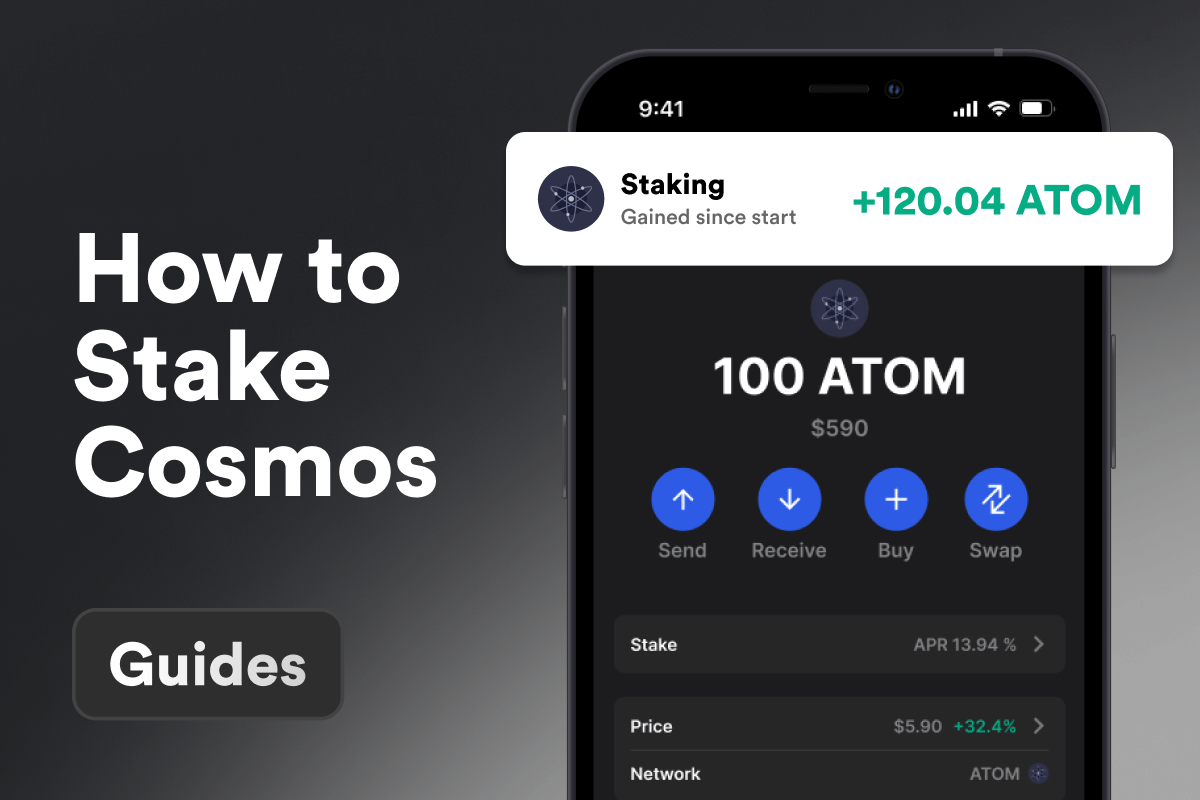

The rise of decentralized finance (DeFi) and the use of decentralized applications (DApps) have eliminated the need for intermediaries like banks, and this appeals to individuals seeking greater control over their finances; it has made some investment opportunities like NFTs, cryptocurrency staking, and yield farming possible.

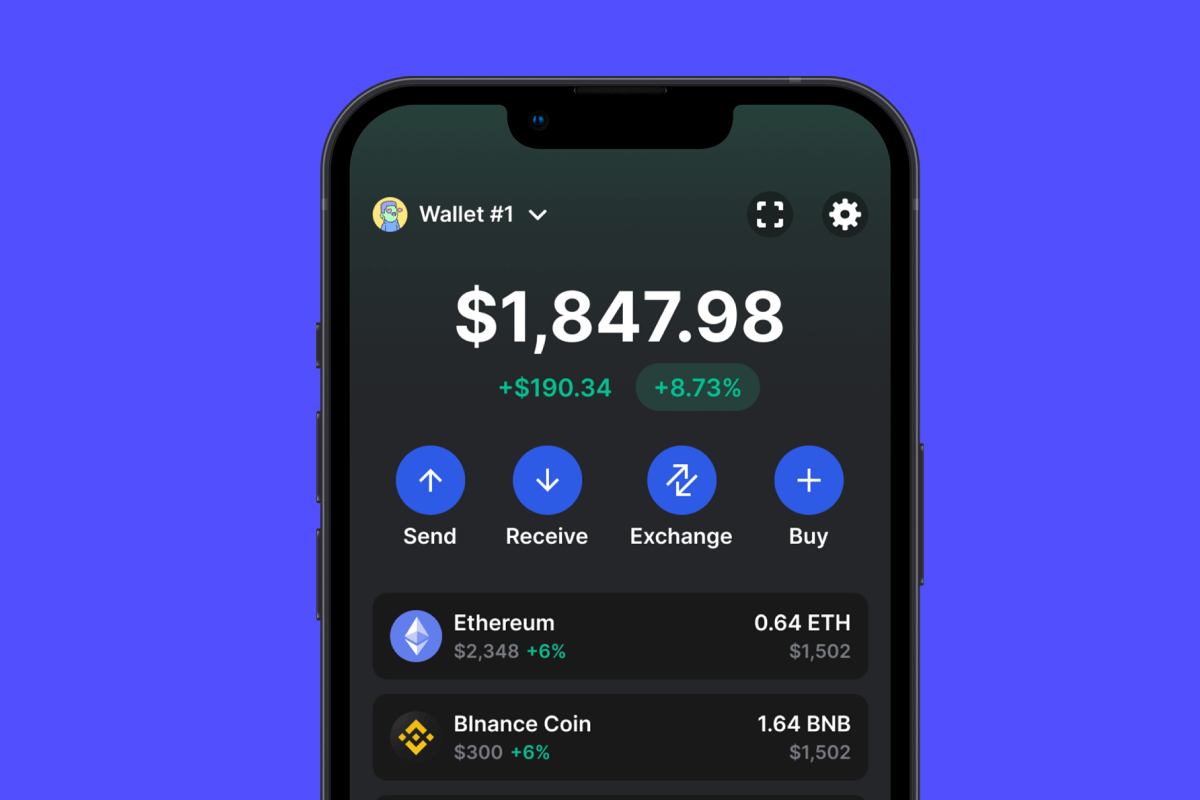

Blockchain technology and cryptocurrencies have been used to improve financial inclusion as unbanked individuals or in underserved communities require just an internet connection and a device to access their digital wallets (such as Gem Wallet) and make fast and seamless transactions across the globe. The blockchain network’s decentralized nature helps promote security and transparency, eliminating fraud and data manipulation. The advent of blockchain technology has revolutionized the finance space, and it is gradually finding use cases in other industries such as healthcare, supply chain, real estate, and many more.

Bottom line

Blockchain technology revolutionizes how we record and verify transactions, creating a decentralized, secure, and immutable ledger. Cryptocurrencies created through mining, such as Bitcoin, Ethereum, and Ripple, can be used as a means of exchange for products and services. As the popularity of blockchain and cryptocurrencies continues to grow, they hold promise for reshaping various industries and finance.