What Is USDY?

USDY - also known as the US Dollar Yield Token - is a digital asset created by Ondo Finance and backed 1:1 by short-term U.S. Treasury bonds. Unlike regular tokens that just sit in your wallet, USDY works on its own: simply hold it, and your balance grows automatically every day as the token’s price increases. Today, USDY is integrated into over 70 projects and available on leading blockchains like Ethereum, Solana, Aptos, Sui, Arbitrum, Mantle, Mantra, and Cosmos (via Noble).

How USDY Earns You Profit

What’s the secret behind USDY’s earnings? It’s simple: the token is backed by short-term U.S. Treasury bonds - reliable government-issued securities that raise capital from investors at a fixed interest rate. In other words, you’re lending funds to the U.S. government and receiving steady returns in exchange. These obligations are considered among the safest financial instruments in the world. Many stablecoins also hold them in reserve, but keep the interest for themselves - that’s part of their revenue model. USDY is built differently: the returns from these bonds are passed directly to the people who hold the token.

Stablecoins are no longer just “digital cash”. A new kind of financial infrastructure is taking shape, where tokens like USDY serve as a modern alternative to traditional savings. This is especially valuable for those living in countries with low interest rates or limited access to banks. And that includes nearly one billion people globally. With USDY, you’re not just preserving value - you’re putting your savings to work.

Stablecoin is a type of cryptocurrency whose price is pegged to a stable asset (such as the US dollar, gold, or euro) at a 1:1 ratio.

USDY Tokenomics

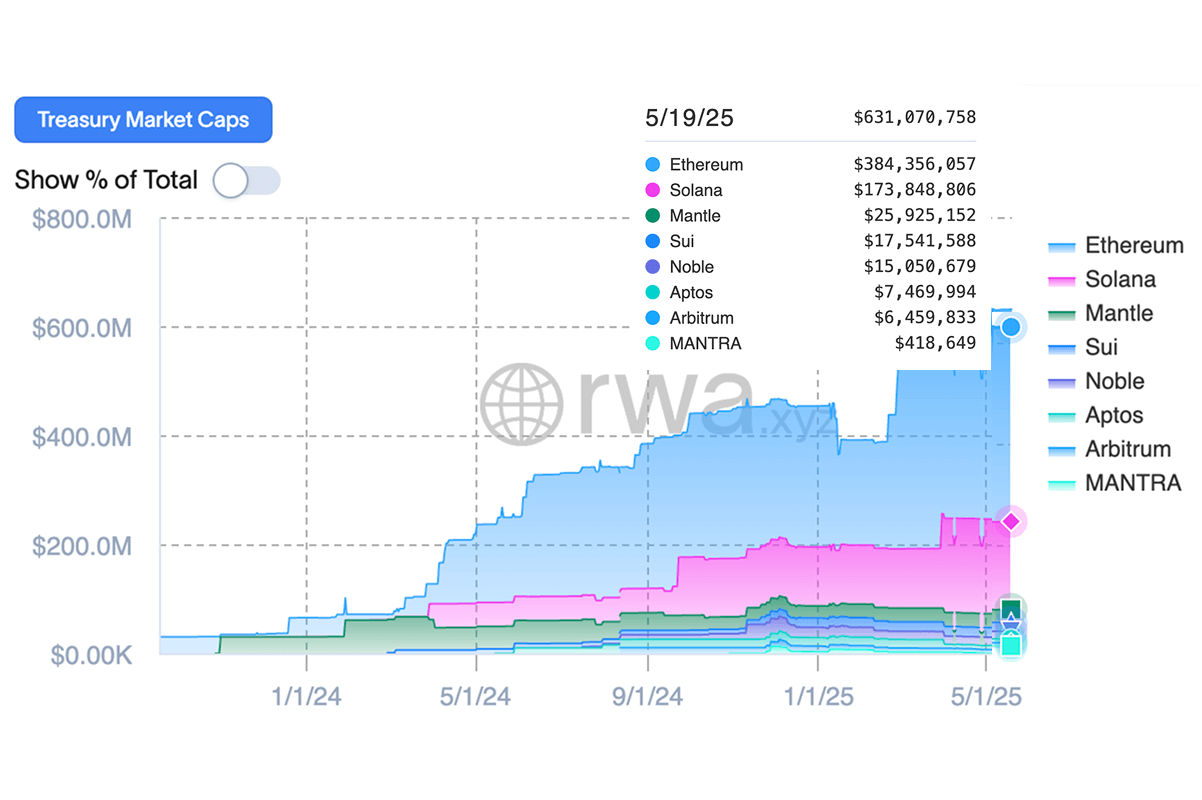

USDY’s key figures reflect its strong market position and growing trust among investors:

Market Capitalization: $587.75 million - showing the scale of current adoption and interest from holders.

Total Supply: Around 581.76 million USDY - indicating steady growth and rising demand.

Circulating Supply: Approximately 535.55 million USDY - highlighting high liquidity and active usage.

Total Market Capitalization of USDY. Source: rwa.xyz

Total Market Capitalization of USDY. Source: rwa.xyz

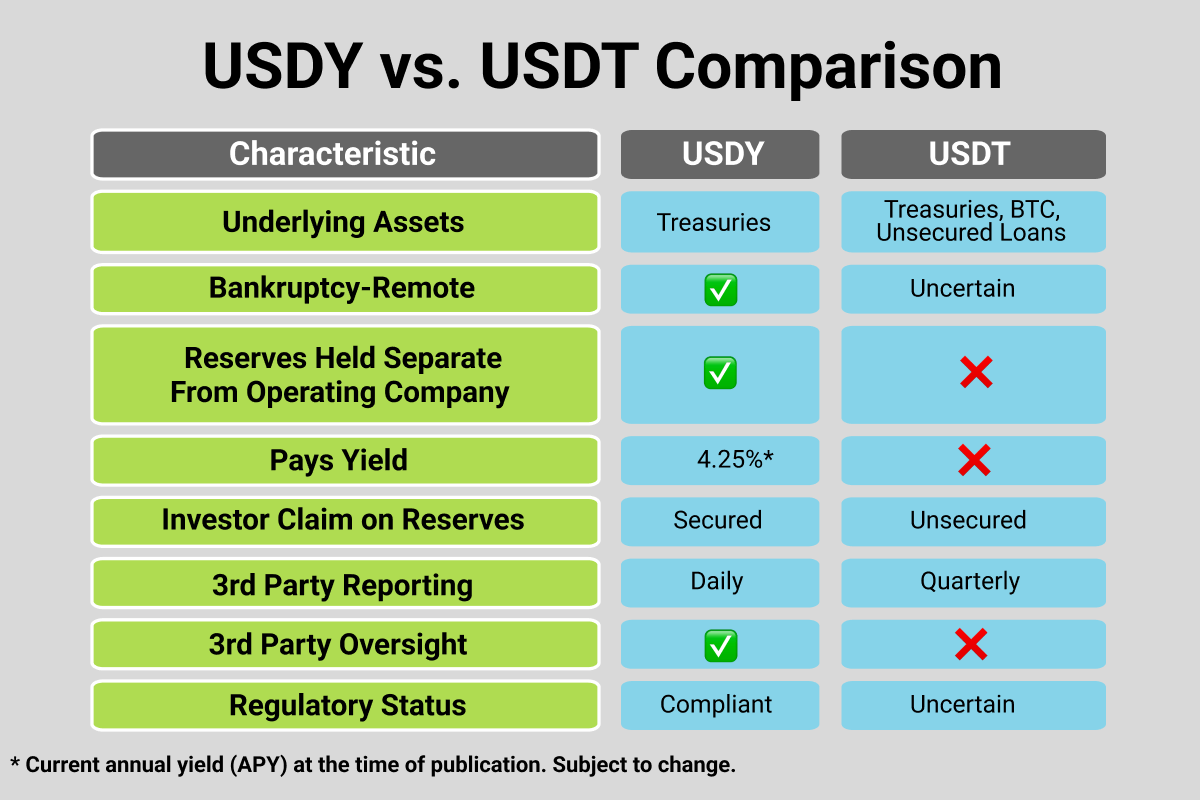

How Is USDY Different From Stablecoins?

Unlike popular stablecoins like USDT and USDC, which are pegged to the dollar but don’t generate earnings, USDY offers a different approach - it’s not classified as a traditional stablecoin: its price increases slightly every day - simply holding the token grows its value. This happens thanks to the earnings from the reliable assets backing it.

But the difference isn’t just about earnings. USDY is a tokenized debt instrument with a transparent legal structure. The reserves are managed by an independent trustee - Ankura Trust Company - which provides daily reporting and oversight. Unlike many stablecoins operating in a regulatory gray area, USDY is issued in full compliance with U.S. federal and state laws - giving holders enhanced legal protection, including in cases of issuer bankruptcy or technical failure.

USDY vs. USDT Comparison

USDY vs. USDT Comparison

USDY or rUSDY: Forms of the US Dollar Yield Token

USDY is available in two formats, allowing users to choose the most convenient way to receive returns depending on how and where they plan to use the token.

-

USDY (Accruing Version): The yield is reflected in the increasing price of the token. You simply hold USDY, and its value gradually rises over time. This is ideal if you prefer to see growth in the form of price appreciation - especially for long-term holding.

-

rUSDY (Rebasing Version): The “r” stands for rebasing. In this version, the price stays stable - around $1 - and the yield is reflected by an increase in the number of tokens in your balance. For example: if you bought 100 rUSDY when the price of USDY was $1.00, and then the price of USDY rose to $1.01, the price of rUSDY would still be $1.00 - but your wallet would now show 101 rUSDY instead of 100.

Both versions can be instantly swapped back and forth in Gem Wallet, depending on whether you prefer to see growth in price or in token quantity.

Rebasing is a mechanism where the number of tokens in your balance changes, not the price. This keeps the value stable while increasing the number of tokens you hold.

Use Cases for USDY

USDY is a yield-bearing stablecoin that’s easy to use in everyday life. It suits both individual users and institutional investors:

1. Savings: Store USDY as a reliable alternative to a bank deposit. Planning a vacation in six months and want to set aside $5,000? Instead of putting it in the bank for 1%, you buy USDY and earn a bit over 4% annually - without locking your capital and while keeping full control.

2. Salaries & Freelance Income: Freelancers and remote workers can receive USDY as a stable alternative to USDT or USDC - but with added yield. The token simply sits in your wallet while generating income until you’re ready to use it.

3. DeFi Applications: USDY can be used as collateral to borrow, participate in yield farming strategies, or trade derivatives across decentralized protocols.

4. Global Transfers: USDY enables fast, borderless payments via blockchain - no banks, no currency conversion costs. Need to pay your daughter’s tuition in Europe? Just send USDY in seconds.

5. Institutional Use: For hedge funds, DAO treasuries, and family offices, USDY serves as a secure, income-generating instrument for managing idle liquidity.

How Can You Earn With USDY

Earning with USDY doesn’t require any special knowledge. Just install the wallet, get your tokens, and let the yield start building - it’s that easy.

Set Up a USDY Wallet

To begin, install the USDY Wallet - a mobile, multi-chain self-custody wallet. Your private keys stay with you, and no registration, email, or third-party access is required. It’s fully decentralized and secure.

How to Acquire USDY

Earning with USDY starts with buying the token. In the past, fixed-income investments were only available to banks and investment funds - now, all you need is a phone. You can purchase USDY directly through the wallet using a credit card - the entire process takes less than a minute.

How Yield Is Earned

Income starts accruing immediately after purchase - and it’s backed by real-world assets, not market volatility. At the time of writing, USDY offers an annual yield of 4.25% APY. The rate is set at the beginning of each month and distributed evenly, increasing your balance every day. You can choose between USDY or rUSDY - depending on how you prefer to track your earnings.

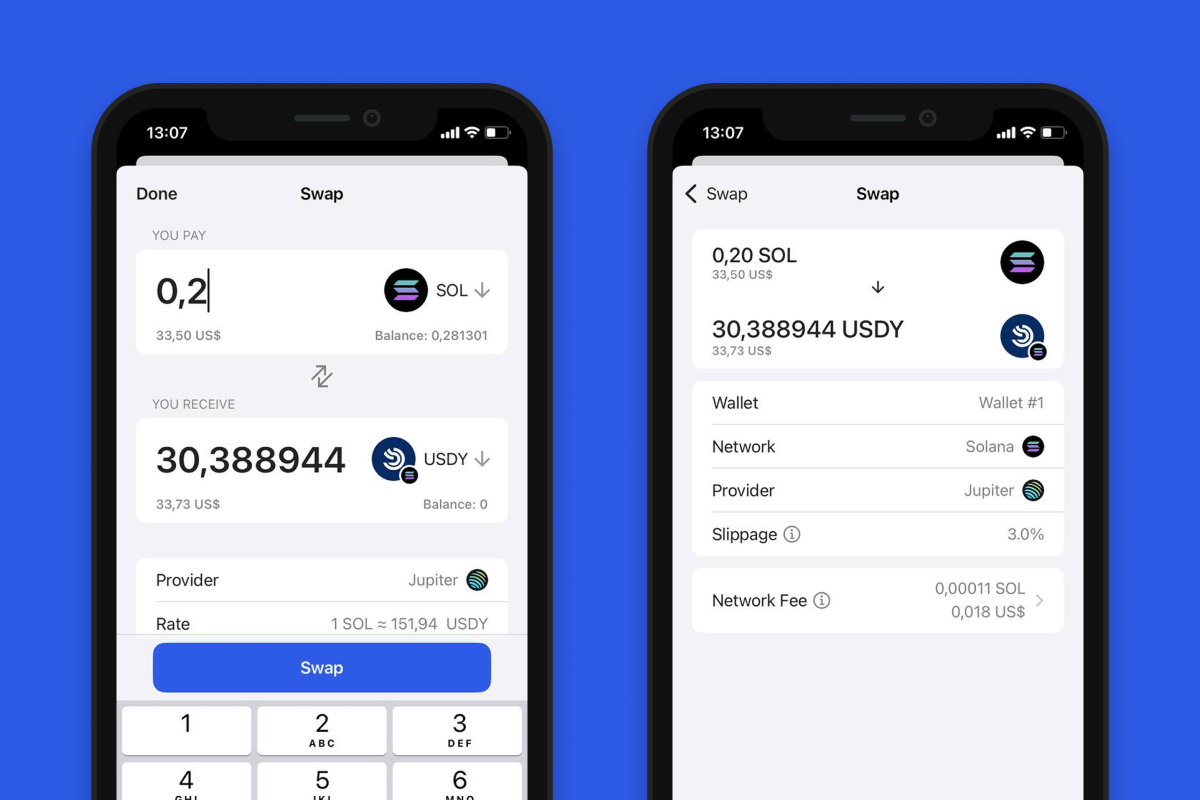

Swap USDY

In addition to earning passive yield by simply holding it, you can easily swap other tokens for USDY. For example, if you have some SOL in your balance and want to get USDY, you can do it in just a few clicks right inside the wallet using the built-in swap powered by Jupiter. The entire process is fast, seamless, and stays within the app.

Swap SOL to USDY on the Solana network

Swap SOL to USDY on the Solana network