Understanding Crypto Mining

When you consider crypto mining, what do you imagine? Do you imagine a team digging underground for cryptocurrencies? Or perhaps heavy machinery excavating topsoil in search of coins? Although this imagery might be accurate for certain precious minerals, crypto mining operates in a completely different manner. What exactly is it, and why is there so much discussion about mining cryptocurrencies? Let’s dive in.

What Is Crypto Mining?

Crypto mining is the process of generating new coins of an existing cryptocurrency. However, unlike fiat currency which can be printed at will, crypto mining follows a distinct approach.

Each cryptocurrency transaction is verified and recorded on a digital ledger known as a blockchain. This chain of blocks is securely maintained using cryptography. A key question arises: how is the integrity and consensus of the blockchain verified? This is where crypto mining plays a crucial role.

Miners receive newly created coins as a reward for ensuring the absence of issues like double spending, by verifying the integrity of each transaction. This process involves solving complex mathematical problems or “proofs,” which are intentionally challenging to solve but straightforward to verify. When a miner successfully resolves one of these problems, they are permitted to add a block of transactions to the blockchain. As compensation for their efforts, they are rewarded with newly minted coins.

Mining Hardwares and Mining Pools

In the early stages of cryptocurrency, mining was done using standard personal computers. However, as the complexity of the mathematical problems escalated, these computers became insufficiently powerful. This led miners to transition to more robust graphics processing units (GPUs), and eventually, to specialized hardware known as ASICs (Application-Specific Integrated Circuits), which are tailored exclusively for mining purposes. These pieces of hardware are similar to the shovels and axes in traditional mining, indispensable for the process to occur.

Mining Pools

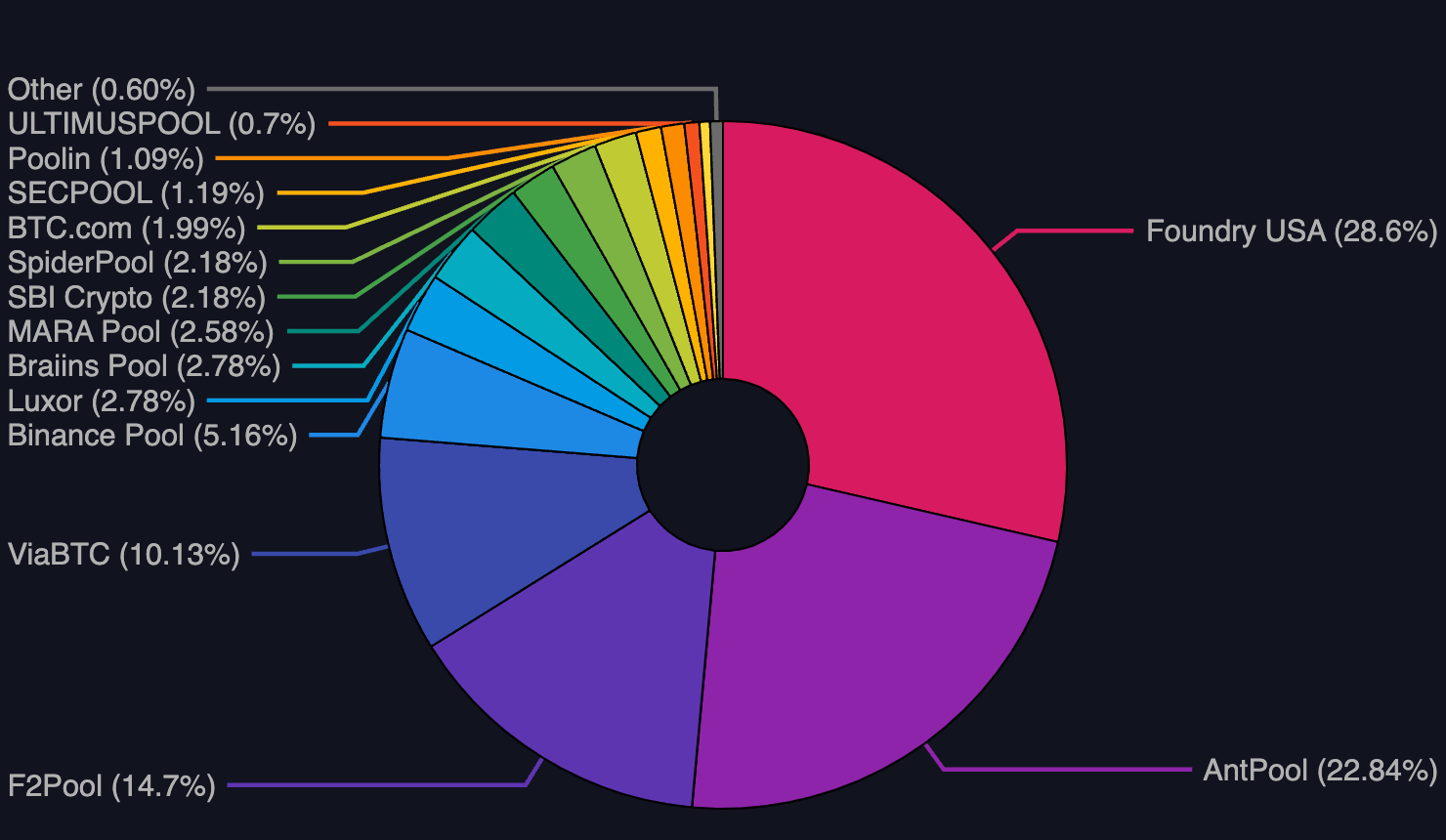

Given the highly competitive nature of mining, it’s relatively uncommon for an individual miner to possess the computational power necessary to add blocks to the blockchain on their own. Consequently, miners frequently collaborate, pooling their computational resources in what are known as mining pools.

These mining pools enable miners to collectively share their processing power across the network. In return, the rewards are distributed proportionally to the amount of work each miner contributes to the likelihood of finding a block.

TOP BTC mining pools. Source: mempool.space

TOP BTC mining pools. Source: mempool.space

Other Consensus Mechanisms

It’s important to know that crypto mining does not involve all cryptocurrencies. Only cryptocurrencies that operate under the proof-of-work consensus have miners. Major examples of this include Bitcoin, Monero, and Litecoin

Proof-of-Stake (PoS)

As good as the proof-of-work consensus is, there is one major concern that plagues it— bad environmental impact. The huge energy consumption needed for PoW to be fully functional has led to developments of other consensus Mechanisms, of which the proof of stake (PoS) is the most popular.

Under the PoS, validators (the PoS equivalent of miners) are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. PoS is often perceived as a less energy-intensive process since it removes the element of computational “work” from the equation.

Delegated Proof of Stake (DPoS)

DPoS is a variant of the traditional PoS model and is used by platforms like EOS and Tron. In DPoS, token holders don’t directly validate transactions and create blocks. Instead, they elect delegates, sometimes referred to as witnesses or block producers, to do this on their behalf. These delegates are responsible for maintaining the network’s integrity and can be voted out if they fail to perform.

Proof of Authority (PoA)

In Proof of Authority, transactions and blocks are validated by approved accounts, known as validators. Validators are generally chosen for their reputation and are expected to act in the best interest of the network. PoA is faster and more energy-efficient than PoW. However, because validators are known entities, PoA networks are more centralized and may be more susceptible to censorship.

The Future of Crypto Mining

Even with many novel consensus mechanisms, crypto mining is still revered in the cryptocurrency space. The only caveat to this is the ongoing discussion about the sustainability of mining practices, with some cryptocurrencies actively seeking greener alternatives or modifying their consensus mechanisms to reduce their environmental impact.

Hopefully, as the crypto space continues to mature, mining will undoubtedly continue to adapt and evolve alongside it.