What Is XRP Ledger Blockchain?

The XRPL Blockchain, or XRP Ledger, is a decentralized, open-source blockchain technology that provides a fast and energy-efficient transaction infrastructure. It is primarily known for its digital payment protocol and native cryptocurrency, XRP. XRPL operates differently from traditional proof-of-work blockchains, using a consensus protocol that significantly reduces transaction time and energy consumption. This makes it an attractive platform for cross-border transactions and micropayments. Additionally, XRPL allows for the issuance of custom tokens and supports various decentralized finance (DeFi) applications, making it a versatile tool in the digital asset space.

Differences Between XRPL and Other Blockchains

-

Built for Business: XRPL is tailored for business needs, providing a reliable and scalable solution for enterprise blockchain applications.

-

Low Cost: Transaction costs on XRPL are minimal, making frequent or high-volume transactions more economical compared to other blockchains.

-

Speed: Known for its rapid transaction processing, XRPL settles transactions in just seconds, essential for real-time business operations.

-

High Throughput: With the capability to handle thousands of transactions per second, XRPL ensures efficient processing even during peak times.

-

Proven Reliability: Over 10 years of error-free performance and more than 63 million ledgers, XRPL offers a stable and dependable blockchain solution for businesses.

-

Motivated Community: A strong, active community of developers and enthusiasts drives continuous innovation and relevance for XRPL in the evolving business landscape.

Speed and Scalability in XRPL: How It Works

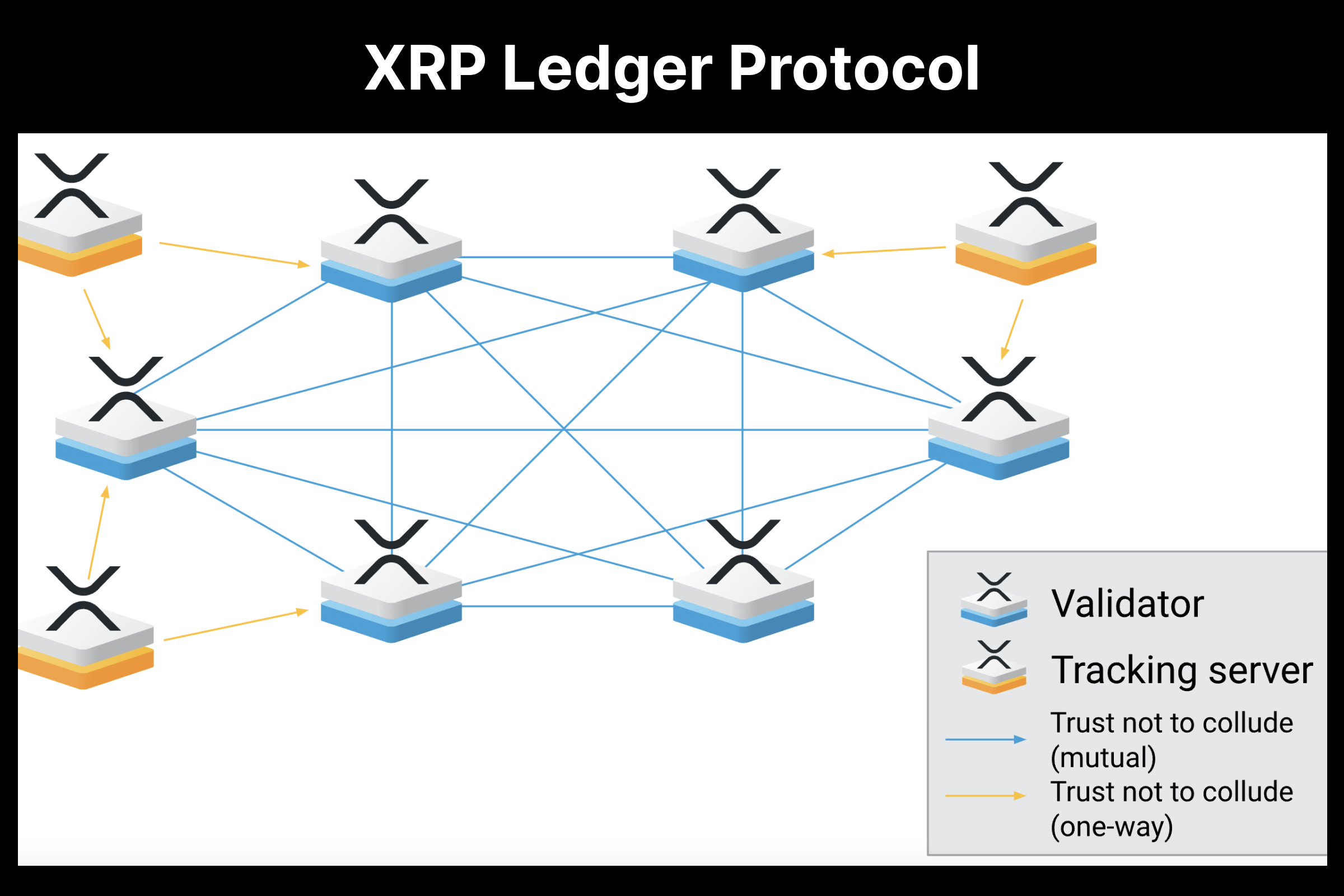

The XRPL operates using a unique consensus process, which differs significantly from the traditional proof-of-work system used in many other blockchains, and involves two key stages: consensus and validation. In the consensus stage, network servers share transaction information and agree on a set to be processed. Validators are crucial here, with each server evaluating proposals from trusted validators. The validation stage sees each server independently verifying consensus results, ensuring network consistency. This two-stage approach allows the XRPL to efficiently process transactions while maintaining network integrity and reliability.

Participants in the XRP Ledger Protocol. Source: xrpl.org

Participants in the XRP Ledger Protocol. Source: xrpl.org

Key Features of the XRPL Blockchain

XRPL is a blockchain platform primarily focused on financial and business operations. Its core functions include:

-

Cross-Currency Payments: Seamlessly settle multi-hop payments across currencies or national boundaries, facilitating efficient international transactions.

-

Payment Channels: Offers batched micropayments with unlimited speed, secured using XRP, ideal for handling numerous small transactions efficiently.

-

Multi-Signing: Provides flexible security options for managing on-ledger accounts, enhancing custody and safety.

-

Tokens: Supports representation of all currencies other than XRP as tokens (or “IOUs”) on the XRP Ledger, allowing diverse asset management.

-

Anti-Malicious: The XRP Ledger blockchain is safeguarded against malicious use through the implementation of minimum balance requirements for addresses. This measure complicates and renders futile any attacks aimed at network overload by creating numerous addresses for flooding. It’s an effective strategy to maintain network integrity and prevent spam.

-

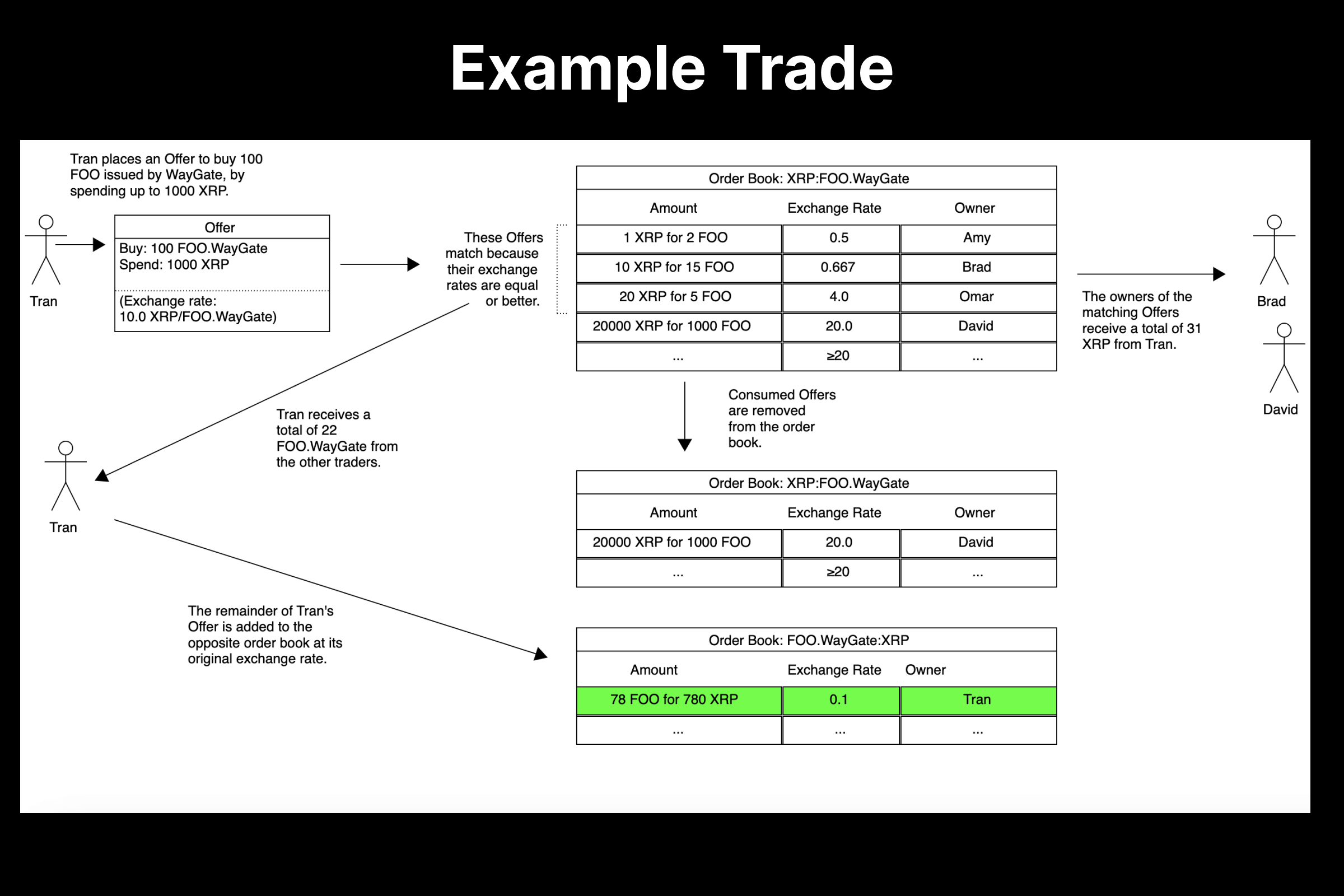

Decentralized Exchange: A robust, built-in decentralized exchange on the blockchain, enabling peer-to-peer multi-currency transactions with high performance.

XRPL Decentralized Exchange - Example Trade. Source: xrpl.org

XRPL Decentralized Exchange - Example Trade. Source: xrpl.org

XRP Ledger Blockchain and Smart Contracts

Smart contracts (XRPL Hooks) on the XRPL are currently under development, so it’s challenging to predict their final form. However, it’s expected that they will maintain a focus on financial and business operations, specifically tailored for various escrows and multisigning payments. This development aims to enhance the XRPL’s functionality while staying aligned with its core use cases in finance and business.

XRP: Key to XRP Ledger Blockchain

The XRP token is the native currency of the XRP Ledger, primarily utilized for covering network fees and transaction expenses within its ecosystem. As the cornerstone of the XRP Ledger, XRP facilitates efficient and rapid transactions across the network.

Tokenomics of XRP

-

Initial Creation: 100 billion XRP tokens were created by Ripple Labs.

-

Founders’ Allocation: 20% of the total supply was allocated to the founders.

-

Escrow Accounts: In 2017, 55 billion XRP were placed in escrow accounts, with 1 billion released monthly.

-

Re-escrowing: Unspent XRP each month is returned to the escrow, extending the release schedule.

-

Deflationary Aspect: XRP has a mild deflationary nature due to the burning of small transaction costs.

-

Longevity: Despite deflation, the XRP supply is projected to last for many thousands of years.

Uses of XRP Token

-

Transaction Fees: XRP tokens are required for all transactions on the XRP Ledger. This encompasses wallet-to-wallet transfers, moving tokens to exchanges, or any other network activities. XRP ensures efficient transaction processing.

-

IOUs (Issued Currencies) tokens: To manage assets on the XRPL network, the native XRP token is necessary. XRP can be securely stored in a Gem Wallet, offering both safety and convenience. Alternatively, it’s possible to purchase XRP directly using a credit card. No matter the method chosen, it’s crucial to remember the role of XRP in facilitating asset management on the XRPL.

-

XRP Ledger Reserve: The XRP token is used to fulfill the base reserve and owner reserves requirements of the XRPL network. These reserves help protect the network against misuse, such as spam or flooding, by ensuring accounts hold a minimum balance of XRP.

-

NFT: XRP tokens are integral for NFT-related activities on the XRP Ledger, including creating new NFT collections and buying existing NFTs. XRP’s efficient and scalable platform supports these transactions effectively.