What Is Injective Blockchain?

The Injective Blockchain is a groundbreaking layer-1 protocol, renowned for its unique focus on decentralized finance (DeFi) applications. Operating on a Proof-of-Stake (PoS) consensus mechanism, it offers a blend of speed, security, and scalability, making it a prime choice in the blockchain space. One of its standout features is the robust support for various financial markets, including futures, options, and perpetuals, all fully on-chain. Injective’s emphasis on interoperability, particularly with Ethereum and other major blockchains, positions it as a versatile and accessible platform. This blockchain not only caters to seasoned crypto enthusiasts but also paves the way for new users to seamlessly engage with DeFi’s expansive possibilities.

Brief History and Development

Injective Protocol, conceptualized by Eric Chen and Albert Chon, began its journey in 2018. It quickly garnered attention after being incubated by Binance Labs and winning the Binance Dexathon. Injective’s mainnet, launched in 2020, marked a significant milestone, introducing a fully decentralized layer-1 blockchain optimized for DeFi. This launch set the stage for its innovative financial ecosystem, integrating cross-chain trading capabilities and a robust decentralized order book, making Injective a standout in the blockchain space.

Differences Between Injective and Other Blockchains

Injective Protocol stands out with its unique layer-1 architecture, optimized for DeFi and featuring full cross-chain interoperability. It integrates a decentralized order book, a rarity among blockchains, which enhances trading efficiency and security.

For more detailed insights into Injective capabilities, you can read further here: What Is The Injective Blockchain?

What You Need to Know About Injective and Its Ecosystem

The Injective Protocol is meticulously designed for finance and DeFi applications, emphasizing efficiency, security, and versatility. Its architecture meets the advanced needs of modern financial markets and decentralized finance ecosystems. Key Players of the Ecosystem:

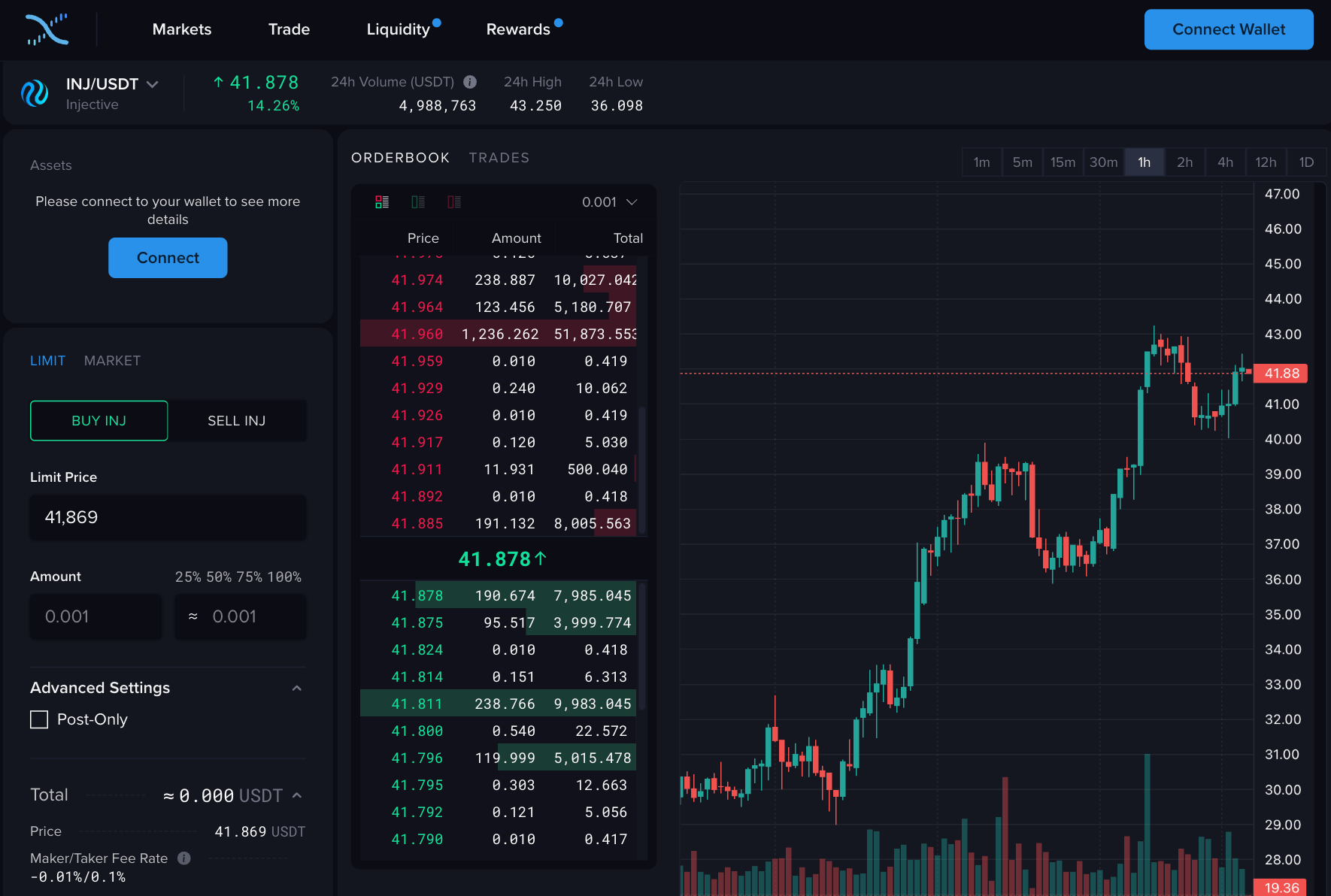

Orderbook Exchange Helix

Helix redefines decentralized trading with its premier orderbook exchange for crypto assets and derivatives. It stands out with zero gas fees, user-friendly design, and unique interchain market offerings.

Helix, a decentralized orderbook crypto exchange, mirrors the functionality and feel of a traditional financial exchange. Source: helixapp.com

Helix, a decentralized orderbook crypto exchange, mirrors the functionality and feel of a traditional financial exchange. Source: helixapp.com

DeFi Protocol Mito

A pioneering DeFi protocol, Mito enhances automated trading and yield generation, alongside innovative launchpad solutions.

Asset Management Black Panther

This protocol offers advanced strategies for digital asset management, aiming to maximize returns.

NFT Marketplace Talis

Talis leads as Injective’s first native NFT marketplace, pioneering the integration of NFTs and finance (NFT Fi) within the ecosystem.

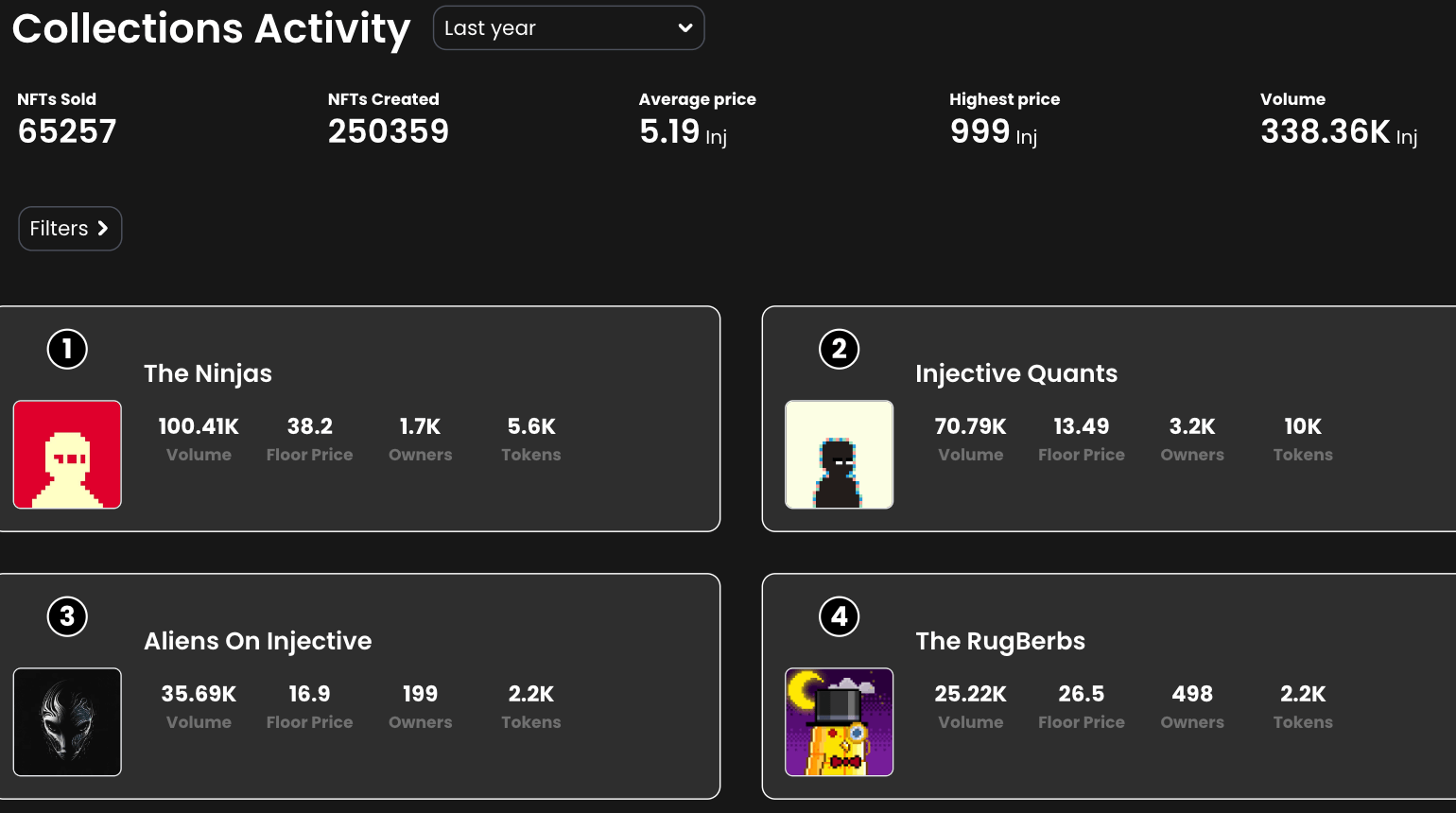

TOP Injective NFT collections and trading activity. Source: talis.art

TOP Injective NFT collections and trading activity. Source: talis.art

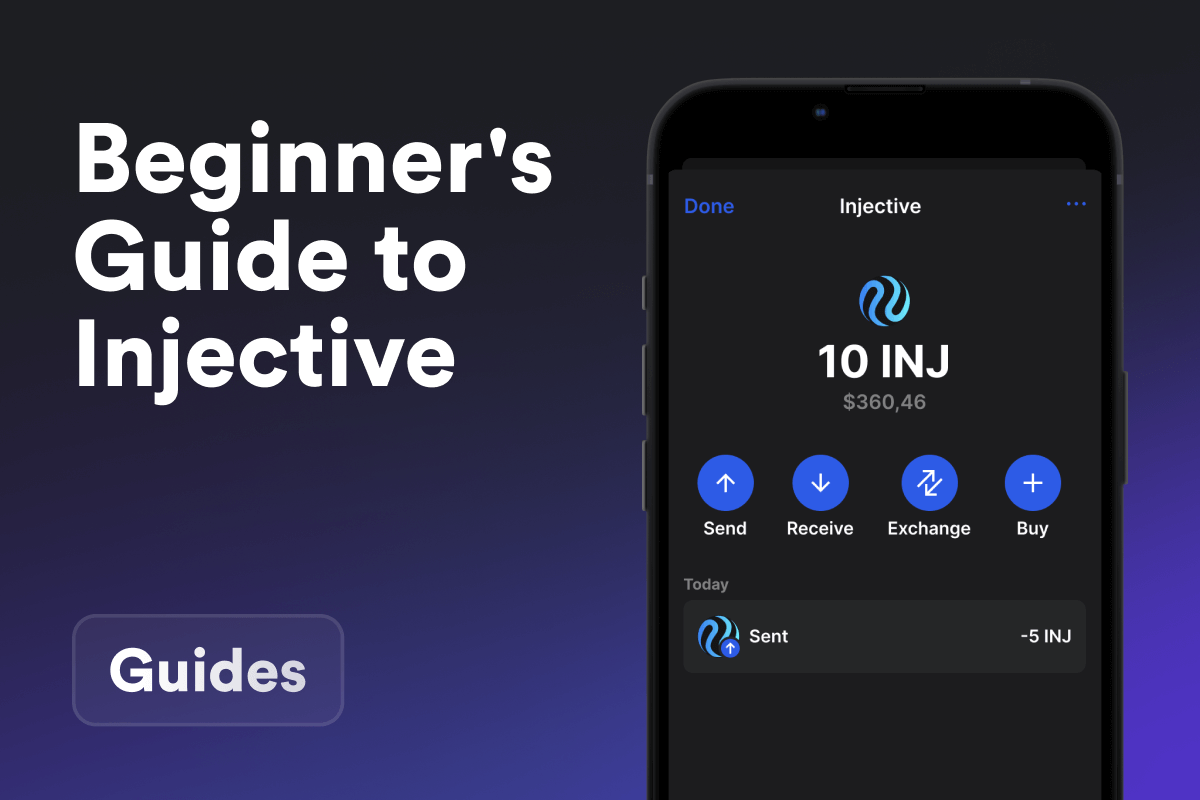

Getting Started With Injective Blockchain

Setting Up an Injective Wallet

Begin by creating an Injective wallet your gateway to the Injective ecosystem, for storing, sending, and receiving INJ tokens. Additionally, it enables you to connect and utilize decentralized orderbook crypto exchanges like Helix. For a straightforward setup, download the Gem Wallet app, and create or import your account.

Acquiring INJ Tokens

Acquire INJ tokens via exchanges, peer-to-peer transfers, or as competition rewards. For convenience, buy INJ directly using a credit card in the Gem Wallet app. This method simplifies the process, saves time, and reduces the risk of wallet address errors. Alternatively, you can swap other tokens for INJ, enhancing your trading flexibility.

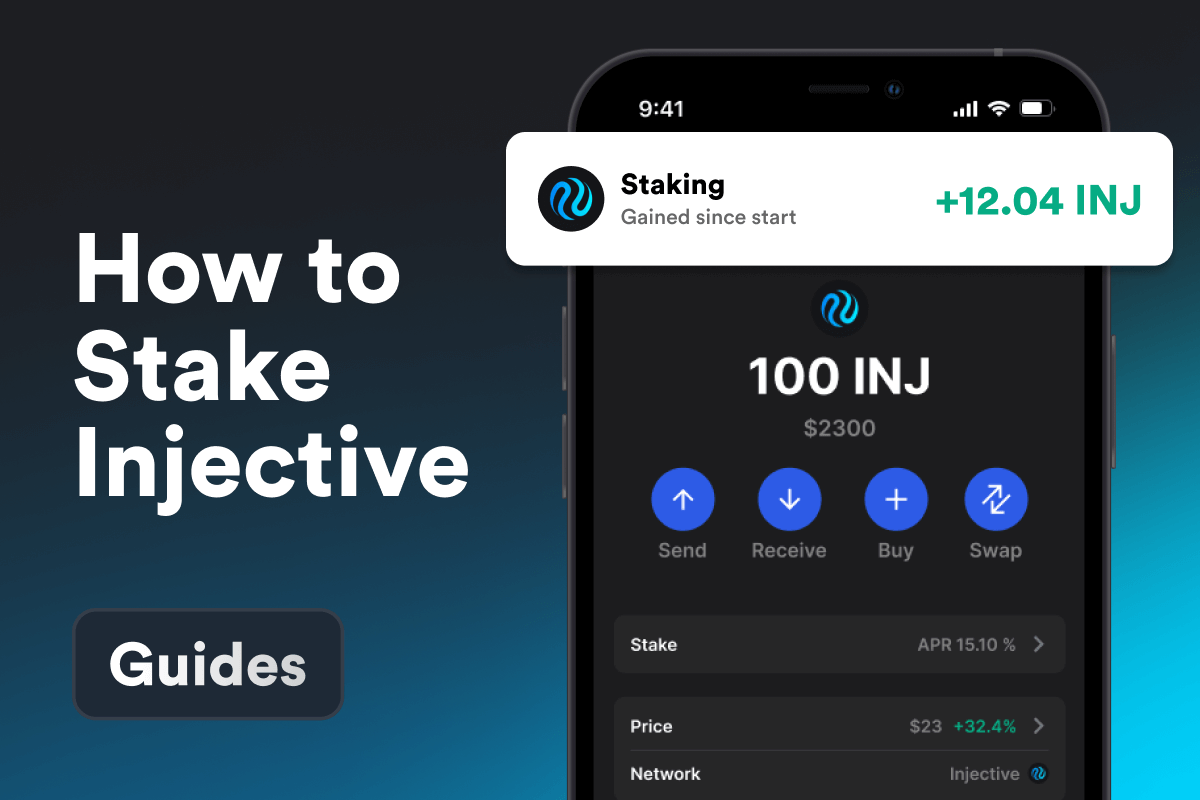

Staking INJ

To actively engage in the Injective network or earn passive income, consider staking your INJ tokens. This is an essential role in ensuring the network’s security and stability.

Get a Unique Name for Your INJ Network Address

Gem Wallet supports the INJ Naming Service, enabling the use of simple, human-readable names ending with “.inj”, like ‘Mark.inj’, instead of long, complex addresses. This greatly enhances the blockchain user experience, offering a user-friendly way to manage addresses and adding an extra layer of protection against errors by simplifying address verification.