What Is Litecoin Blockchain?

The Litecoin Blockchain, launched in October 2011 by Charlie Lee, has been at the forefront of digital currency innovation. With its Scrypt hashing algorithm, it ensures rapid transaction confirmations, reducing block generation time to 2.5 minutes, a significant improvement compared to Bitcoin’s 10 minutes. The blockchain has successfully processed over 66 million secure transactions, with a maximum cap of 84 million LTC, creating an environment of controlled supply. In May 2017, Litecoin implemented Segregated Witness (SegWit), a pivotal step towards scalability and integration with the Lightning Network, marking a milestone in its evolution.

Litecoin vs Bitcoin

Since the creation of the first blockchain, Bitcoin, developers have been inventing, developing, and implementing increasingly enhanced and complex versions of the original blockchain. Litecoin, on the other hand, belongs to the first generation of Bitcoin’s evolution. With its emergence, it introduced lower transaction fees than Bitcoin and higher throughput capacity, which directly influenced transaction speed.

Of course, when looking at modern blockchains such as Solana or Injective, it may be difficult to be impressed by a block generation time of 2.5 minutes in Litecoin. However, Litecoin is valuable as one of the earliest blockchains, known for its reliability and time-tested performance. If Bitcoin is often referred to as digital gold, Litecoin proudly bears the name of digital silver.

Now, let’s examine the improvements that have been implemented in this blockchain compared to Bitcoin:

- Relise Date: Litecoin 2011 vs Bitcoin 2008

- Total Supply: Litecoin 84M vs Bitcoin 21M

- Block Time: Litecoin 2.5m vs Bitcoin > 10m

Litecoin Halving

Litecoin, which adopted the halving model from Bitcoin, undergoes a halving approximately every four years. During a halving event, the reward provided to miners for validating transactions and adding new blocks is reduced by 50%. This decrease in miner rewards serves to regulate the inflation rate and guarantees a capped supply of Litecoin, with a maximum of 84 million coins. Historically, Litecoin halving events have resulted in substantial price increases, as the diminished supply frequently ignites heightened demand from investors.

Litecoin SegWit

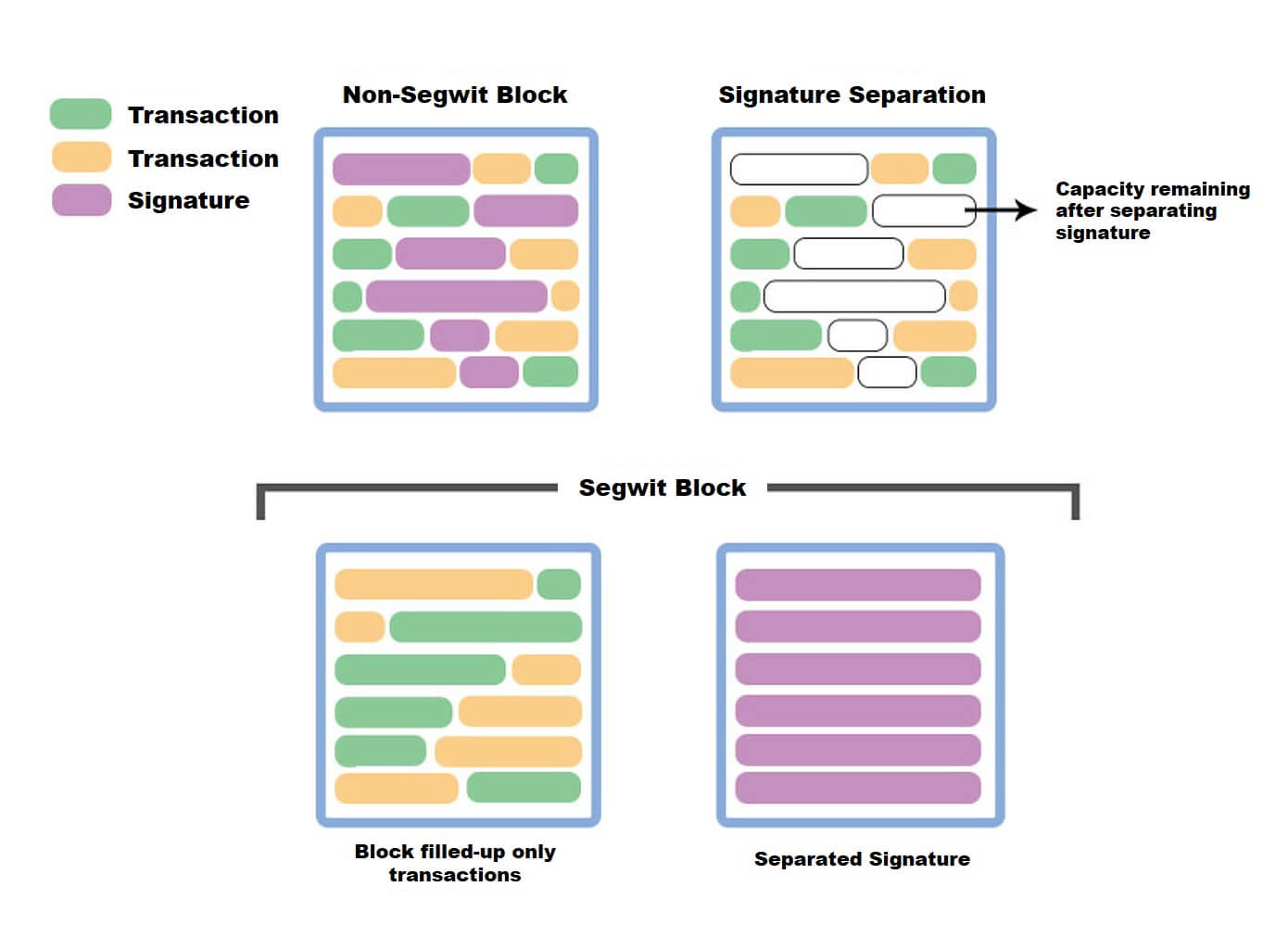

Segregated Witness (SegWit) is a critical upgrade in the Litecoin blockchain, enhancing its functionality in several ways. It accomplishes this by segregating the witness data (transaction signatures) from the transaction data itself. This separation resolves the issue of transaction malleability, ensuring the security and reliability of Litecoin transactions.

SegWit also contributes to increased transaction capacity by reducing the size of each transaction, allowing more of them to be included in a single block. This leads to faster confirmation times and lower transaction fees for Litecoin users.

Furthermore, SegWit compatibility paves the way for the Lightning Network, a second-layer scaling solution that enables almost instant and cost-effective microtransactions on the Litecoin network.

Lastly, SegWit introduces script versioning, providing flexibility for future upgrades and innovations in the Litecoin blockchain. In summary, Segregated Witness significantly improves the efficiency, scalability, and potential for advanced features in the Litecoin blockchain.

Litecoin SegWit illustration. Source: followin.io

Litecoin SegWit illustration. Source: followin.io

LTC: Coin of Litecoin Blockchain

Let’s take a look at popular use cases for LTC.

Uses of LTC

-

Transaction Fees: To make payments on the Litecoin blockchain, you will need LTC to cover the network fee. This fee goes to miners, who, in turn, ensure the security and functionality of the entire blockchain. You can acquire LTC coins either by transferring them from an exchange or by purchasing them with a credit card directly into your ltc wallet in just a few clicks.

-

Investing: Litecoin is one of the earliest blockchains, and in combination with its dedicated community, it becomes an attractive asset for investments. Investors value this blockchain not only for its innovations but also for its stability, reliability, and time-tested security.

-

Payments: Litecoin is quite popular as a means of payment, especially when looking at blockchain-based options rather than stablecoins. Its low transaction fees and relatively fast confirmations, coupled with security features, make LTC supported by various marketplaces and payment providers. For more details, read our Litecoin guide.