Staking has emerged as a popular method for cryptocurrency holders to earn passive income and actively participate in the maintenance and security of blockchain networks. In this comprehensive guide, we will explore the concept of staking, its benefits, and how it works. We will also delve into the different types of staking, such as proof of stake and liquid staking, and highlight the risks involved. So, let’s dive in and unravel the world of staking.

Understanding Staking

Staking refers to the process of locking up a certain amount of cryptocurrency, known as your “stake,” to support the security and operation of a blockchain network. By staking your coins, you actively participate in validating transactions on the blockchain, ensuring its integrity and consensus. In return for your contribution, you earn rewards in the form of additional cryptocurrency.

Staking is made possible through the proof of stake (PoS) consensus mechanism, which is employed by certain blockchain networks. Unlike the proof of work (PoW) mechanism used by cryptocurrencies like Bitcoin, which relies on miners solving complex mathematical puzzles, PoS selects validators based on the amount of cryptocurrency they hold and are willing to lock up as collateral.

How Does Staking Work?

To understand how staking works, let’s take a closer look at the proof of stake consensus mechanism. In PoS, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to stake. The more cryptocurrency a validator holds, the higher their chances of being selected as a validator and earning rewards.

Validators lock up their stake by holding their cryptocurrency in a designated wallet or by delegating their stake to a staking pool. Delegating to a staking pool allows users with smaller amounts of cryptocurrency to combine their stakes with others, increasing their chances of being selected as a validator and earning rewards.

Validators are responsible for verifying transactions and maintaining the security of the network. If a validator acts maliciously or violates the rules of the network, they may be penalized through a process known as “slashing,” which involves the confiscation of a portion or all of their staked coins.

The Benefits of Staking

Staking offers several benefits to cryptocurrency holders, making it an attractive option for those looking to grow their holdings and earn passive income. Let’s explore some of the key benefits of staking:

Earning Passive Income

One of the primary benefits of staking is the ability to generate passive income. By staking your cryptocurrency, you can generate additional coins as rewards for your contribution to the network. These rewards are often denominated as a percentage yield, which can be significantly higher than traditional interest rates offered by banks.

Supporting Network Security

Staking plays a crucial role in maintaining the security and decentralization of blockchain networks. By actively participating in the validation process, stakers help secure the network and ensure the integrity of transactions. Validators who act honestly and in the best interest of the network are rewarded, while those who act maliciously risk losing their staked coins.

Decentralization and Governance

Staking also promotes decentralization by allowing anyone with cryptocurrency to participate in the validation process. This helps prevent a single entity from gaining control over the network and enhances its overall security. In some blockchain networks, stakers may also have voting rights and the ability to influence the governance and decision-making processes of the network.

Energy Efficiency

Compared to the energy-intensive proof of work mechanism, staking is considered a more energy-efficient and environmentally friendly alternative. The validation process in proof of stake requires significantly less computing power, reducing the carbon footprint associated with cryptocurrency mining.

Liquidity and Flexibility

While your stake is locked up during the staking period, many staking protocols allow you to retain a certain level of liquidity and flexibility. Some networks offer the ability to unstake your coins, allowing you to access your funds if needed. This flexibility sets staking apart from other investment options that may require locking up your funds for extended periods.

Types of Staking

Staking comes in different forms, depending on the specific blockchain network and its implementation of the proof of stake consensus mechanism. Let’s explore two notable types of staking: proof of stake and liquid staking.

Proof of Stake (PoS)

Proof of stake is the most common form of staking and is employed by blockchain networks like Ethereum, Cardano, and Cosmos. In PoS, validators are selected based on the amount of cryptocurrency they hold and are willing to stake. The more coins a validator stakes, the higher their chances of being selected to validate transactions and earn rewards.

Validators in a PoS network can either run their own validator nodes or delegate their stake to a staking pool. Running a validator node requires technical expertise and the resources to maintain the node’s infrastructure. On the other hand, delegating to a staking pool allows users to combine their stake with others, increasing their chances of earning rewards without the need for running their own node.

Liquid Staking

Liquid staking is a newer concept that aims to address the liquidity issue associated with traditional staking. In traditional staking, the staked coins are locked up and cannot be used or traded until the staking period ends. Liquid staking protocols solve this problem by issuing tokenized versions of the staked coins, known as liquid staking tokens (LSTs).

LSTs represent the staked assets and can be used in other decentralized finance (DeFi) systems to generate additional yield and reward opportunities. This allows stakers to earn rewards on their staked assets while also having the flexibility to use them for other purposes within the DeFi ecosystem.

One of the largest liquid staking tokens currently in TVL (Total Value Locked) is Lido stETH on Ethereum.

Risks and Considerations

While staking offers numerous benefits, it’s important to be aware of the risks and considerations associated with this investment strategy. Here are some key points to keep in mind:

Volatility Risk

Cryptocurrency prices can be highly volatile, and a significant drop in the value of your staked coins can outweigh the rewards earned from staking. It’s important to consider the potential impact of price fluctuations on your overall investment.

Slashing Risk

Validators in proof of stake networks face the risk of being penalized or “slashed” if they act maliciously or violate network rules. Slashing can result in the loss of a portion or all of the staked coins, so it’s essential to adhere to network guidelines and maintain a reliable and secure infrastructure.

Technical Risk

Staking requires a certain level of technical expertise, especially for those running their own validator nodes. Technical failures, such as software bugs or network disruptions, can result in the loss of staked coins or missed rewards. It’s crucial to stay updated on network developments and maintain a secure staking setup.

Lock-up Periods

When staking your cryptocurrency, you typically need to commit to a lock-up period during which your coins are inaccessible. This lock-up period can vary depending on the blockchain network and may restrict your ability to sell or transfer your staked coins during this time.

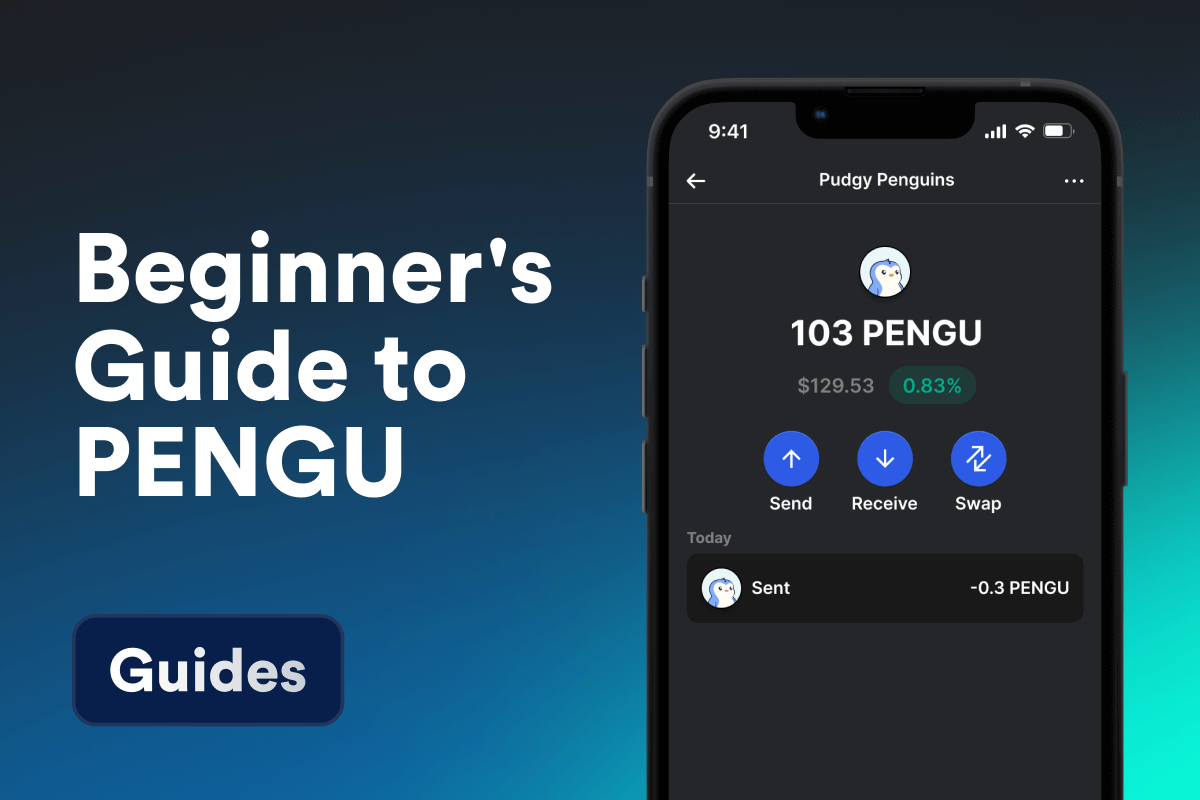

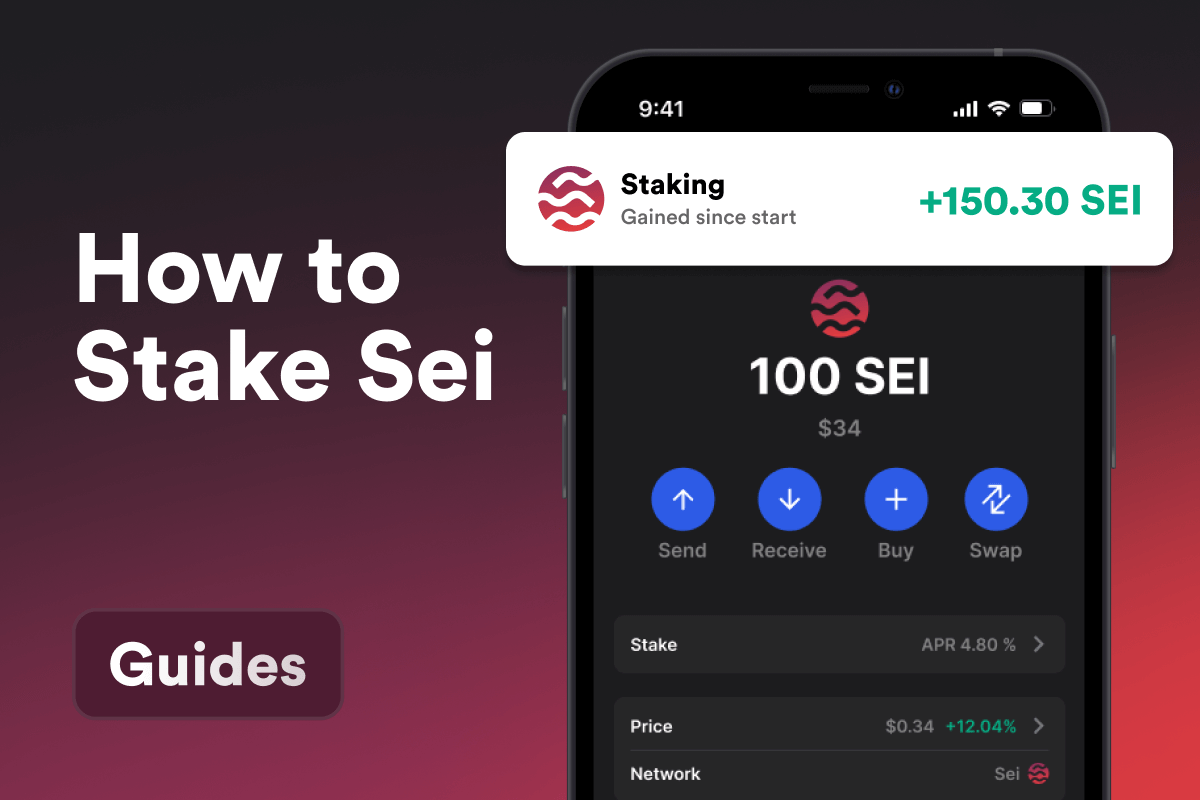

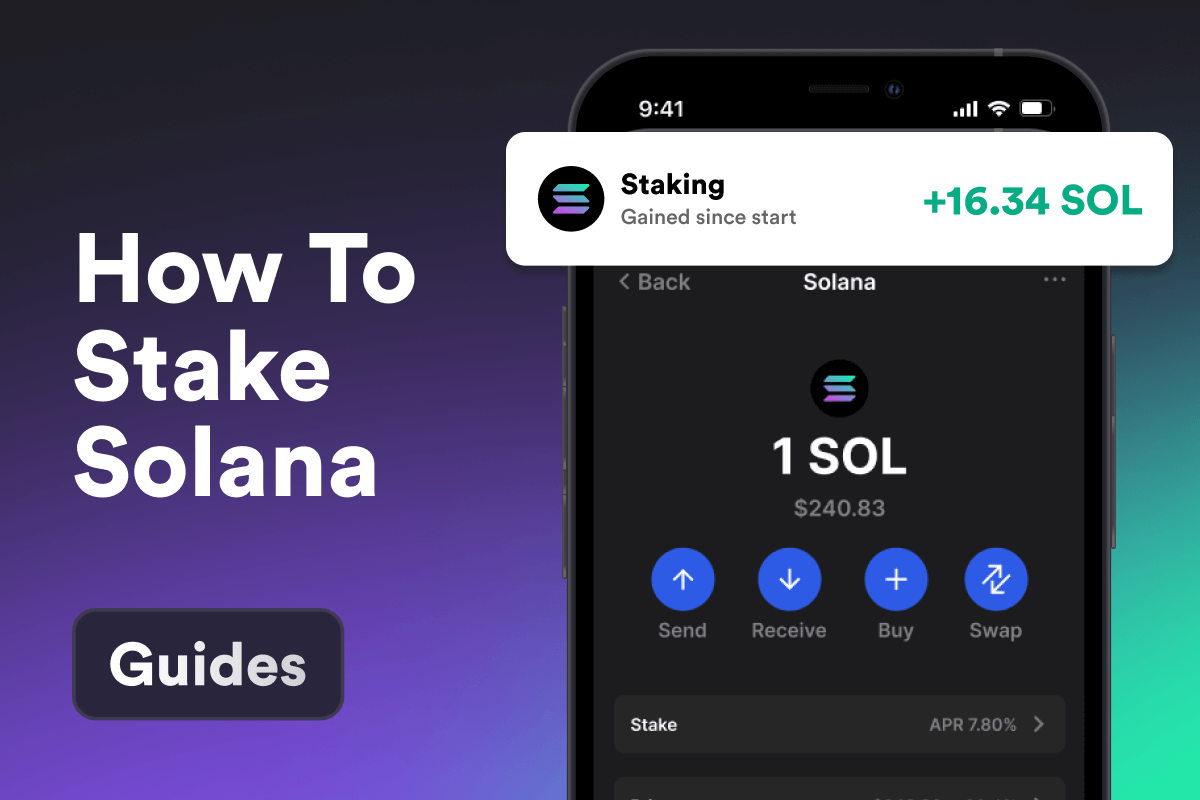

Staking Opportunities with Gem Wallet

If you’re interested in exploring staking opportunities with convenience and ease, look no further than Gem Wallet. Gem Wallet is a mobile wallet available for iOS and Android that allows you to stake your favorite cryptocurrencies directly through the app. With Gem Wallet, you can easily connect to your favorite decentralized applications (dApps) and start earning passive income through staking.

Gem Wallet offers a user-friendly interface, robust security features, and seamless integration with various staking protocols. Whether you’re a beginner or an experienced cryptocurrency investor, Gem Wallet provides a convenient and secure platform to participate in staking and generate passive income from your crypto holdings.

Download Gem Wallet today and embark on your staking journey with confidence and convenience.

Conclusion

Staking has revolutionized the cryptocurrency space, offering a unique opportunity for investors to earn passive income while actively participating in the maintenance and security of blockchain networks. By staking your cryptocurrency, you contribute to the decentralization and security of the network while enjoying the benefits of staking rewards.

However, it’s important to approach staking with caution and consider the risks involved. Volatility, slashing risks, technical challenges, and lock-up periods are factors that require careful consideration. By staying informed, conducting thorough research, and choosing reputable staking platforms or wallets like Gem Wallet, you can make informed decisions and maximize the potential of staking as a passive income strategy.

Staking is an exciting avenue for crypto enthusiasts to engage with blockchain networks and contribute to the growth and development of the crypto ecosystem.