Cryptocurrencies have revolutionized the financial world with their decentralized nature and ability to facilitate peer-to-peer transactions without the need for intermediaries. However, the volatility of popular cryptocurrencies like Bitcoin has hindered their adoption for everyday transactions. This is where stablecoins come in. In this comprehensive guide, we will explore the concept of stablecoins, their types, use cases, and their significance in the cryptocurrency market.

Introduction to Stablecoins

Stablecoins are a category of cryptocurrencies that aim to address the price volatility issues faced by traditional cryptocurrencies like Bitcoin and Ethereum. Unlike these volatile assets, stablecoins are designed to maintain a stable value by being pegged to an external asset, typically a fiat currency like the US dollar. This pegging mechanism ensures that the value of stablecoins remains relatively constant, providing stability for users and enabling them to be used as a medium of exchange or a store of value.

Stablecoins offer a bridge between the world of cryptocurrencies and traditional financial systems. They combine the advantages of blockchain technology, such as fast and secure transactions, with the stability of fiat currencies. This makes stablecoins an attractive option for individuals and businesses looking for a reliable digital currency that can be used for everyday transactions without the volatility associated with other cryptocurrencies.

What Makes a Stablecoin Stable?

Stablecoins achieve price stability through various mechanisms, which can be broadly categorized into three types: fiat-collateralized stablecoins, crypto-collateralized stablecoins, and algorithmic stablecoins.

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by reserves of fiat currency, such as the US dollar, held in bank accounts or other custodial entities. For example, Tether (USDT), one of the most popular stablecoins, claims to be backed 1:1 by US dollars held in reserve. Other fiat-collateralized stablecoins include USD Coin (USDC) and TrueUSD (TUSD).

The reserves backing these stablecoins are regularly audited to ensure transparency and maintain trust in the stability of the coins. When a user wants to redeem their stablecoins for fiat currency, the equivalent amount of the underlying fiat currency is released from the reserve.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies. These stablecoins require overcollateralization, meaning that the value of the collateralized cryptocurrency is higher than the value of the stablecoins issued. MakerDAO’s Dai (DAI) is an example of a crypto-collateralized stablecoin, where the stablecoin is backed by a basket of cryptocurrencies, primarily Ethereum (ETH).

The collateralized cryptocurrencies are held in smart contracts, and the stablecoin issuance and redemption process is governed by these contracts. If the value of the collateral falls below a certain threshold, users may be required to add more collateral or risk their stablecoins being liquidated.

Algorithmic Stablecoins

Algorithmic stablecoins, also known as non-collateralized stablecoins, do not rely on reserves or collateral. Instead, they use algorithmic mechanisms to maintain price stability. These stablecoins adjust their supply based on market demand and supply conditions.

For example, Terra (LUNA) was an algorithmic stablecoin that used an elastic supply model to control its value. It experienced a major collapse in its price and market cap in early May 2022, when the value of its flagship stablecoin, TerraUSD (UST), unexpectedly broke its $1 peg and started to plummet. The sudden price drop triggered a massive minting of LUNA tokens to stabilize the UST value, flooding the market with excess LUNA supply and pushing its price down further. Within a few days, LUNA and UST lost over 90% of its value, wiping out billions of dollars from the crypto market.

Algorithmic stablecoins are designed to automatically increase or decrease their supply in response to price fluctuations. When the price of the stablecoin deviates from its target value, the algorithm triggers mechanisms that either mint new coins or burn existing coins to restore stability.

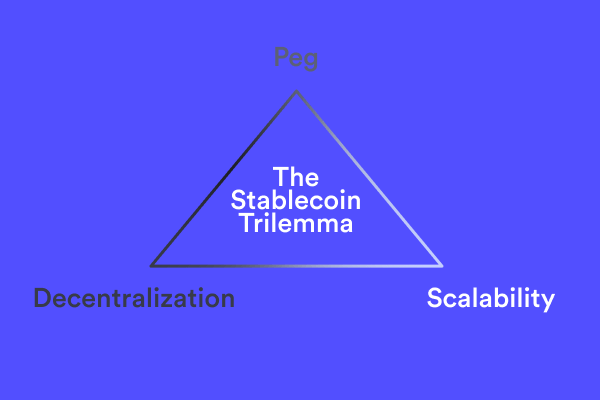

Stablecoin Trilemma

The Stablecoin Trilemma refers to the challenge of providing a stablecoin that is decentralized, scalable and secure. Decentralization means that there is no central authority controlling the issuance and redemption of the stablecoin, while scalability refers to the ability of the stablecoin to handle large transaction volumes. Security refers to protecting user funds from theft, fraud or other malicious activities.

Achieving all three simultaneously has proven difficult, as increasing one often comes at the expense of another. For example, a highly decentralized system can be more difficult to scale than a centralized one. As such, many projects have opted for partial decentralization to achieve scalability and security without sacrificing too much decentralization.

The Stablecoin Trilemma is a major challenge for the industry and projects are constantly looking for new ways to overcome it. One way to address the trilemma is through the use of multi-collateral stablecoins, which provide a higher degree of decentralization and security than single-collateral stablecoins. Multi-collateral stablecoins are backed by multiple assets, providing greater stability and reducing the risk of liquidity shortages.

Additionally, Decentralized Finance (DeFi) protocols can be used to create synthetic assets that can be used as collateral in multi-collateral systems. These protocols are designed to increase scalability and reduce costs while still maintaining decentralization. Ultimately, projects must continue to innovate to find new solutions for the Stablecoin Trilemma that allow them to provide secure, scalable and decentralized stablecoins.

Popular Stablecoins in the Market

The stablecoin market has seen significant growth in recent years, with several stablecoins gaining popularity and adoption. Let’s take a closer look at some of the most prominent stablecoins in the market.

Tether (USDT)

Tether (USDT) is the largest and most widely used stablecoin in the cryptocurrency market. It was launched in 2014 and is designed to be pegged 1:1 to the US dollar. Tether claims to maintain its price stability by holding reserves of US dollars in its custodial accounts. However, the transparency and adequacy of these reserves have been a subject of controversy and scrutiny.

Despite the controversies, Tether has played a crucial role in facilitating liquidity and trading in the cryptocurrency market. It is widely used as a medium of exchange and a trading pair on various cryptocurrency exchanges.

USD Coin (USDC)

USD Coin (USDC) is a stablecoin developed by Coinbase and Circle. It is also designed to be pegged 1:1 to the US dollar and is backed by reserves of US dollars held in audited bank accounts. USDC aims to provide transparency and regulatory compliance, making it an attractive stablecoin for individuals and businesses.

USDC has gained significant adoption in the cryptocurrency market and is supported by various wallets, exchanges, and decentralized finance (DeFi) platforms. Its transparency and regulatory compliance have positioned it as a trusted stablecoin for users looking for a reliable digital currency.

Dai (DAI)

Dai (DAI) is an algorithmic stablecoin created by MakerDAO, a decentralized autonomous organization built on the Ethereum blockchain. Dai is designed to be pegged to the US dollar through an intricate system of smart contracts and collateralized debt positions (CDPs).

The stability of Dai is achieved by users locking up collateral, primarily Ethereum, in CDPs. This collateral is used to generate new Dai, which can be used in various applications. The system automatically adjusts the supply of Dai based on market demand and supply conditions, aiming to maintain its value close to $1.

Dai has gained popularity in the DeFi space and is widely used as collateral for borrowing and lending in decentralized lending platforms.

Use Cases of Stablecoins

Stablecoins have a wide range of use cases in the cryptocurrency market and beyond. Let’s explore some of the primary use cases of stablecoins.

Medium of Exchange

One of the main use cases of stablecoins is to serve as a medium of exchange. The stability of stablecoins makes them suitable for everyday transactions, such as purchasing goods and services. They provide a convenient and reliable alternative to traditional fiat currencies, especially in regions with unstable or inflationary national currencies.

Stablecoins enable users to transact globally without the need for intermediaries and with reduced transaction costs compared to traditional payment systems. They can be easily transferred across borders and utilized in various industries, including e-commerce, remittances, and cross-border payments.

Store of Value

Stablecoins can also function as a store of value, offering individuals and businesses a digital asset that maintains its purchasing power over time. Unlike volatile cryptocurrencies, stablecoins provide stability and protect against inflation or depreciation of value.

Users can hold stablecoins as a digital representation of traditional fiat currencies, allowing them to preserve their wealth and hedge against market volatility. Stablecoins offer a convenient way to store value securely and access it whenever needed without the limitations of traditional banking systems.

DeFi Applications

Decentralized Finance, or DeFi, has emerged as a major use case for stablecoins. DeFi platforms leverage the transparency, security, and programmability of blockchain technology to create financial applications without the need for intermediaries.

Stablecoins play a crucial role in DeFi applications, such as decentralized lending and borrowing, decentralized exchanges (DEXs), and yield farming. They provide liquidity, collateral, and stability to these platforms, enabling users to engage in various financial activities with reduced counterparty risk and increased accessibility.

Stablecoins also serve as a bridge between traditional financial systems and DeFi, allowing users to interact with blockchain-based financial services using familiar fiat currencies.

Advantages of Stablecoins

Stablecoins offer several advantages over volatile cryptocurrencies and traditional fiat currencies. Let’s explore some of the key benefits of stablecoins.

Price Stability

The primary advantage of stablecoins is their price stability. By being pegged to a stable asset, such as a fiat currency, stablecoins provide a reliable value that remains relatively constant over time. This stability makes stablecoins more suitable for everyday transactions and mitigates the risk of price volatility associated with other cryptocurrencies.

Fast and Low-Cost Transactions

Stablecoins leverage blockchain technology to enable fast and low-cost transactions. Unlike traditional payment systems that involve intermediaries and may have lengthy settlement times, stablecoin transactions can be processed quickly and settled within minutes, regardless of geographical boundaries.

Accessibility

Stablecoins offer increased accessibility to financial services, especially for individuals in regions with limited access to traditional banking infrastructure. Stablecoins can be stored and transferred using a simple smartphone and an internet connection, making financial inclusion more attainable for underserved populations.

Challenges and Controversies Surrounding Stablecoins

While stablecoins offer numerous advantages, they also face challenges and controversies that need to be addressed. Let’s explore some of the key concerns surrounding stablecoins.

Centralization and Counterparty Risk

Many stablecoins, especially fiat-collateralized ones, rely on centralized entities to hold reserves and maintain stability. This centralization introduces counterparty risk, as users must trust these entities to manage the reserves transparently and honor redemptions.

Regulatory Concerns

The growing popularity of stablecoins has attracted regulatory scrutiny. Regulators are concerned about the potential risks stablecoins may pose to financial stability, consumer protection, and anti-money laundering efforts. Regulatory frameworks for stablecoins are still evolving, and compliance with existing regulations can be complex for stablecoin issuers.

Transparency and Auditability

The transparency and auditability of stablecoins’ reserves have been a subject of controversy. Some stablecoin issuers have faced criticism for their lack of transparency in disclosing the composition and adequacy of reserves. Establishing trust in stablecoins requires robust auditing and transparency practices to ensure that the stablecoin is genuinely backed by the claimed assets.

The Future of Stablecoins

The future of stablecoins holds significant potential for innovation and adoption. Let’s explore some key aspects that may shape the future of stablecoins.

Innovation and Adoption

Stablecoin projects continue to innovate and explore new mechanisms to improve stability, scalability, and transparency. Ongoing research and development aim to address the challenges faced by current stablecoins and enhance their usability and trustworthiness.

As stablecoins become more user-friendly and gain wider acceptance, their adoption is expected to increase. Stablecoins can serve as a gateway for individuals and businesses to enter the cryptocurrency market, providing a bridge between traditional finance and blockchain-based systems.

Integration with Traditional Financial Systems

Stablecoins have the potential to integrate with traditional financial systems, offering a digital representation of fiat currencies that can be seamlessly used for cross-border transactions, remittances, and other financial services. Collaboration between stablecoin issuers and traditional financial institutions can bridge the gap between traditional and digital finance, creating a more inclusive and efficient global financial system.

Impact on the Global Economy

The widespread adoption of stablecoins has the potential to impact the global economy in significant ways. Stablecoins can enhance financial inclusion, especially in regions with limited access to banking services. They can also facilitate cross-border trade and remittances, reducing transaction costs and friction in international transactions.

However, the growth of stablecoins also raises concerns about monetary sovereignty, financial stability, and regulatory oversight. Striking the right balance between innovation, consumer protection, and regulatory compliance will be crucial for the sustainable development of stablecoins.

Conclusion

Stablecoins are a key innovation in the cryptocurrency space, offering a stable and convenient way to use digital money in various scenarios. Stablecoins allow users to enjoy the benefits of cryptocurrencies, such as speed, security, and transparency, without the drawbacks of price fluctuations and market crashes.

Stablecoins come in different flavors and designs, each with its own advantages and challenges. Stablecoins can enable faster and cheaper cross-border payments, support decentralized finance applications, and foster financial inclusion for the unbanked and underbanked.

Stablecoins are not without risks and uncertainties, however. They face regulatory scrutiny, technical issues, and market competition that could affect their viability and adoption. The future of stablecoins depends on how well they can balance the trade-offs between stability, decentralization, and compliance.

If you are interested in exploring the world of stablecoins and other cryptocurrencies, you need a reliable and user-friendly crypto wallet that supports them. That’s why we recommend you to download Gem Wallet, the best mobile crypto wallet for beginners and experts alike.

Gem Wallet allows you to buy, sell, store, and manage your stablecoins and other cryptocurrencies with ease. You can use your credit or debit card to buy your favorite Stablecoin with a minimum of $50 USD and up to $20,000 USD. You can also access various DeFi platforms and services with Gem Wallet, such as lending, borrowing, staking, and swapping.

Gem Wallet is available on the App Store or Google Play Store, or you can download it as an APK from our website. Don’t miss this opportunity to join the crypto revolution with Gem Wallet, the ultimate Stablecoin Wallet for you. Download it today and start your crypto journey with confidence.