What Is DeFi?

Decentralized Finance, also known as DeFi, is a transformative sector in the financial and crypto industry. It utilizes the power of blockchain technology, with Ethereum being the foundational platform for a large majority of DeFi applications, to cut out intermediaries in financial transactions, shifting power from centralized institutions to individuals. DeFi services include everything from savings and checking accounts to complex financial instruments.

Key Takeaways

DeFi, or "Decentralized Finance," is a groundbreaking financial system built on blockchain technology that aims to democratize finance by removing traditional intermediaries like banks.

DeFi applications strive to replace financial intermediaries, allowing for greater individual control over personal finances.

The Ethereum blockchain is the foundational platform for a large majority of DeFi applications, thanks to its advanced and flexible smart contract capabilities.

DeFi expands the functionality of blockchain beyond simple value transfers, enabling more complex financial operations such as lending, yield farming, and derivatives trading.

DeFi, formerly known as "open finance," advocates for a transparent, open, and permissionless financial ecosystem.

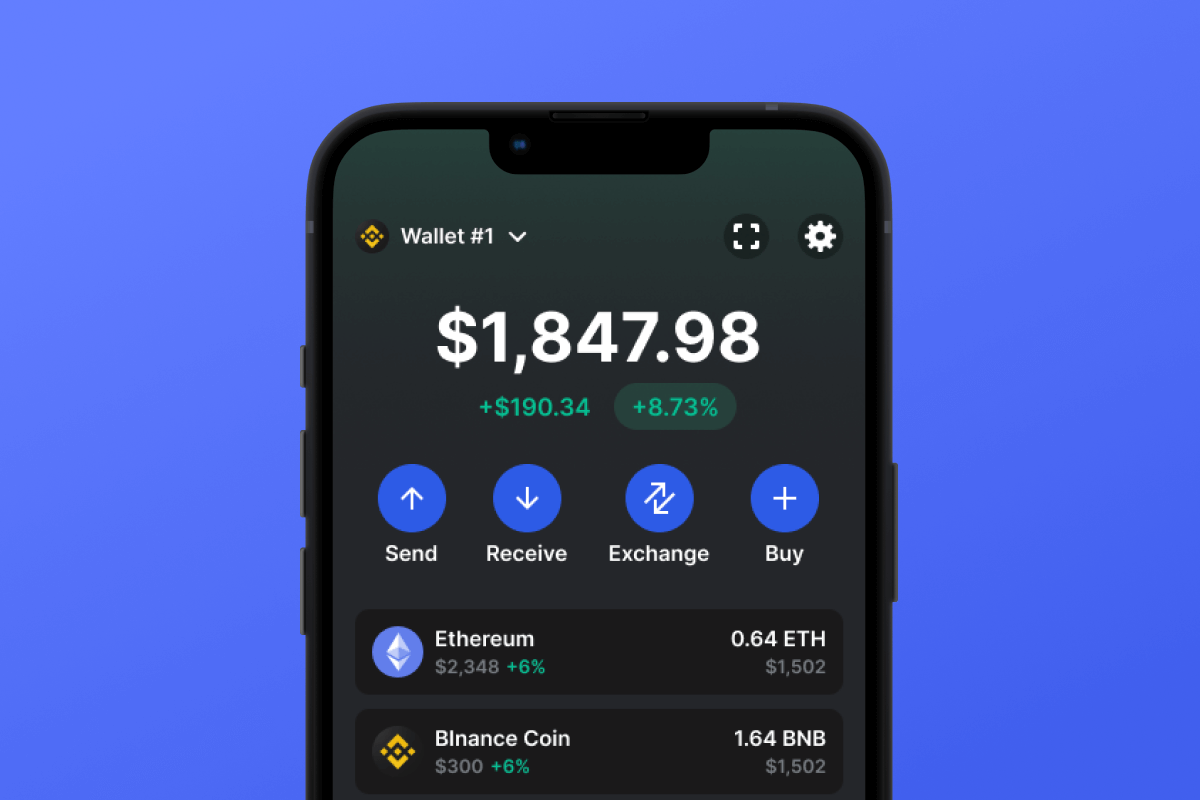

What Is a DeFi Wallet?

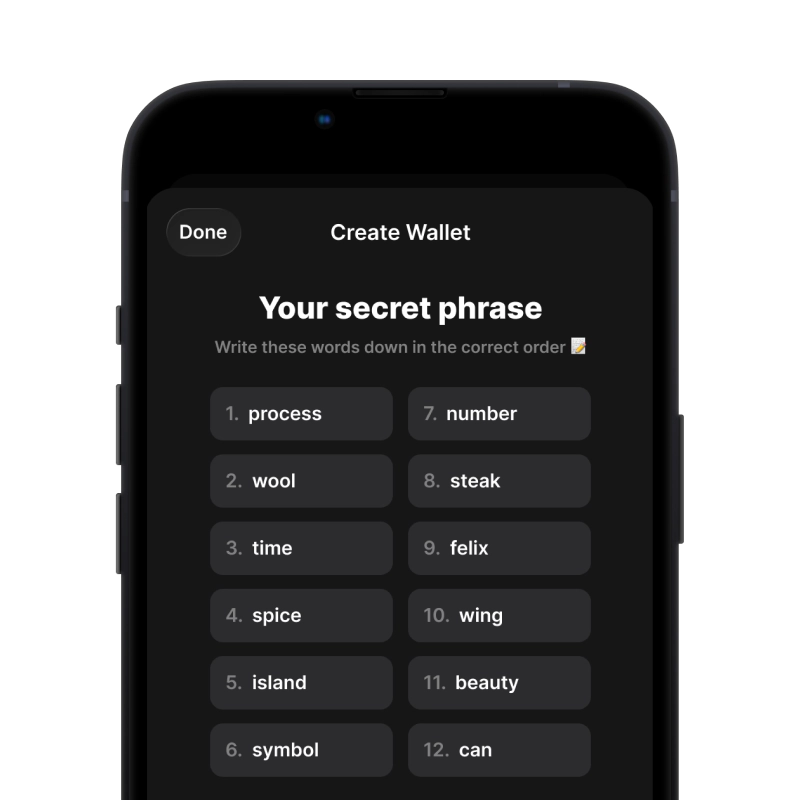

A DeFi wallet is a secure digital storage for your cryptocurrencies. Unlike traditional wallets, DeFi wallets are non-custodial, meaning you have full control over your assets. Only the holder of the private key can access and manage these assets. DeFi wallets are pivotal for participating in the DeFi ecosystem, allowing users to interact with DeFi applications and manage their investments directly.

How Do I Invest in DeFi?

Investing in DeFi is an exciting journey into the world of decentralized finance. This typically involves buying DeFi tokens, which represent a certain stake or right within a DeFi protocol. Tokens can be purchased directly using traditional fiat currencies or by trading other cryptocurrencies. It's important to do thorough research and understand the project behind the token, as well as potential risks and returns.

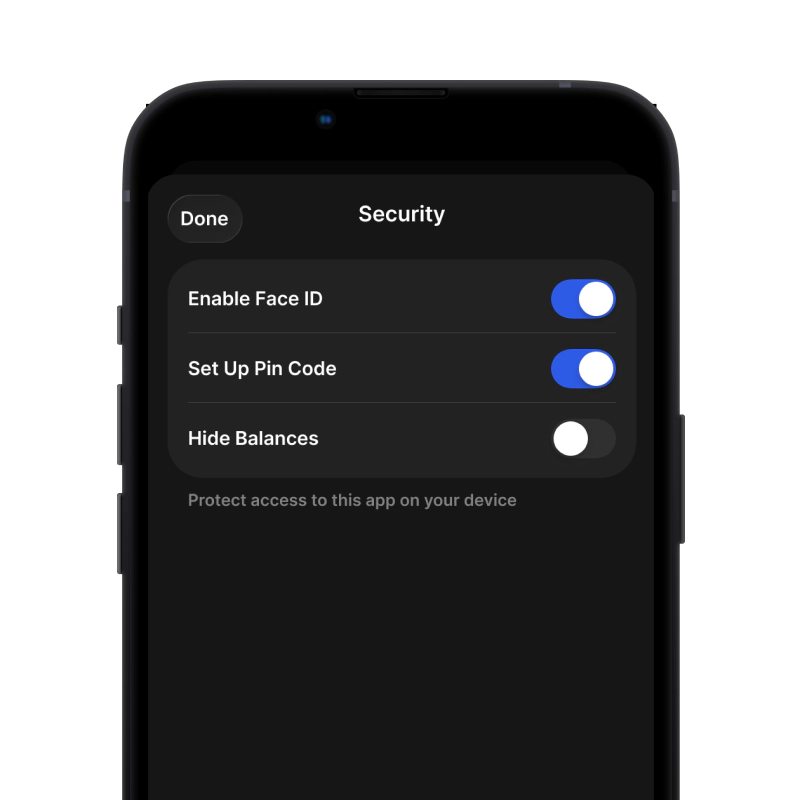

Is DeFi Wallet Safe?

Our DeFi wallet is built with strong security and privacy standards. We follow self-custody and open-source policies, giving you full control over your assets and clear insight into how our wallet works. It's a trustworthy and safe choice, designed to keep your investments secure. With our wallet, you get a reliable and user-friendly way to manage your DeFi assets.

How Does DeFi Work?

Decentralized Finance, or DeFi, works by leveraging the innovations of blockchain technology, typically on platforms like Ethereum or Polygon. Blockchain is the underlying technology that enables the creation of cryptocurrencies and ensures their security and transparency. In the context of DeFi, it facilitates financial interactions without needing a central authority or intermediary.

A key component of DeFi is the use of smart contracts, which are essentially self-executing contracts with the agreement between buyer and seller being directly written into lines of code. This code lives on the blockchain network, making it tamper-proof and transparent to all parties. These smart contracts automatically execute transactions when their predefined conditions are met. This means that once a contract is on the blockchain, it can't be changed, and it will automatically execute as planned.

Consider this example. In a traditional financial setting, you might have an agreement with a bank to send money to a friend on a specific date. You would trust the bank to carry out this transaction on the agreed date. However, with DeFi and smart contracts, this agreement would be written into a smart contract on the blockchain. The contract would automatically send the money from your account to your friend's account on the specified date. There would be no need for a bank or other third party to facilitate the transaction.

What truly sets DeFi apart is the concept of "programmable money." This refers to the ability to automate the movement and management of funds in a highly customizable way. Using smart contracts, money can be programmed to move based on a wide array of triggers and criteria. For example, funds could be programmed to be sent only when certain real-world events occur, like when a specific asset reaches a particular price. This is possible because of the digital nature of cryptocurrencies and the flexibility provided by blockchain technology.

DeFi's programmable nature extends to ERC20 tokens, a popular standard for creating tokens on the Ethereum blockchain. ERC20 tokens are used in many DeFi applications for a variety of purposes, from representing digital assets like cryptocurrencies to tokenizing real-world assets. Through the programming capabilities of smart contracts and the standards set by ERC20, DeFi has created an open, permissionless, and highly programmable financial system.

What Are DeFi Use Cases?

DeFi offers a wide array of applications that mimic traditional financial services and more:

Liquidity Mining / Yield Farming: Users can provide liquidity to DeFi platforms and earn rewards in return.

Lending and Borrowing: DeFi platforms allow users to lend and borrow assets directly, often earning interest on deposits.

Staking: Users can participate in a network's operations and earn rewards by "staking" their tokens.

Trading Tokens: DeFi has given rise to decentralized exchanges, allowing users to trade tokens directly from their wallets.

Insurance: Some DeFi platforms offer coverage against smart contract failures or platform hacks.

Stablecoins: DeFi has spurred the development of stablecoins, like USDC and USDT, which are tied to the value of a fiat currency like USD.

What Is the Difference Between CeFi and DeFi?

CeFi, or Centralized Finance, involves traditional financial intermediaries in transactions and services. Banks, for example, hold your money and facilitate transactions. DeFi, on the other hand, seeks to recreate these services on a decentralized network, cutting out the middlemen and giving individuals more control over their financial interactions.