Was ist Staked Lido ETH (stETH)?

Staked Lido ETH oder stETH ist eine tokenisierte Version, auch Liquid Staking Derivatives (LSDs) genannt, von gestaked Ethereum (ETH) . Dieser Token repräsentiert Ihre im Ethereum 2.0-Einzahlungsvertrag eingesetzten ETH-Bestände zuzüglich Prämien in liquider und handelbarer Form.

- Beim Staking nimmt man an einem Proof-of-Stake-System (PoS) teil, um den Betrieb eines Blockchain-Netzwerks zu unterstützen.

- stETH-Token ermöglichen es Inhabern, durch Ethereum 2.0-Staking Prämien zu verdienen und gleichzeitig die Liquidität zu erhalten.

- Der Wert von stETH steigt mit der Zeit, da es Staking-Belohnungen ansammelt, was die Belohnungen des Ethereum-Stakings direkt widerspiegelt.

- stETH wurde von Lido entwickelt, einer liquiden Staking-Lösung für Ethereum.

Wichtige Fragen

Wann wurde stETH erstellt?

Staked Lido ETH (stETH) wurde im Dezember 2020 als Teil des Angebots der Lido-Plattform eingeführt.

Wer hat stETH erstellt?

stETH wurde von Lido entwickelt, einer dezentralen und autonomen Plattform, die das mit Ethereum-Staking verbundene Liquiditätsproblem lösen soll.

Was kostet stETH?

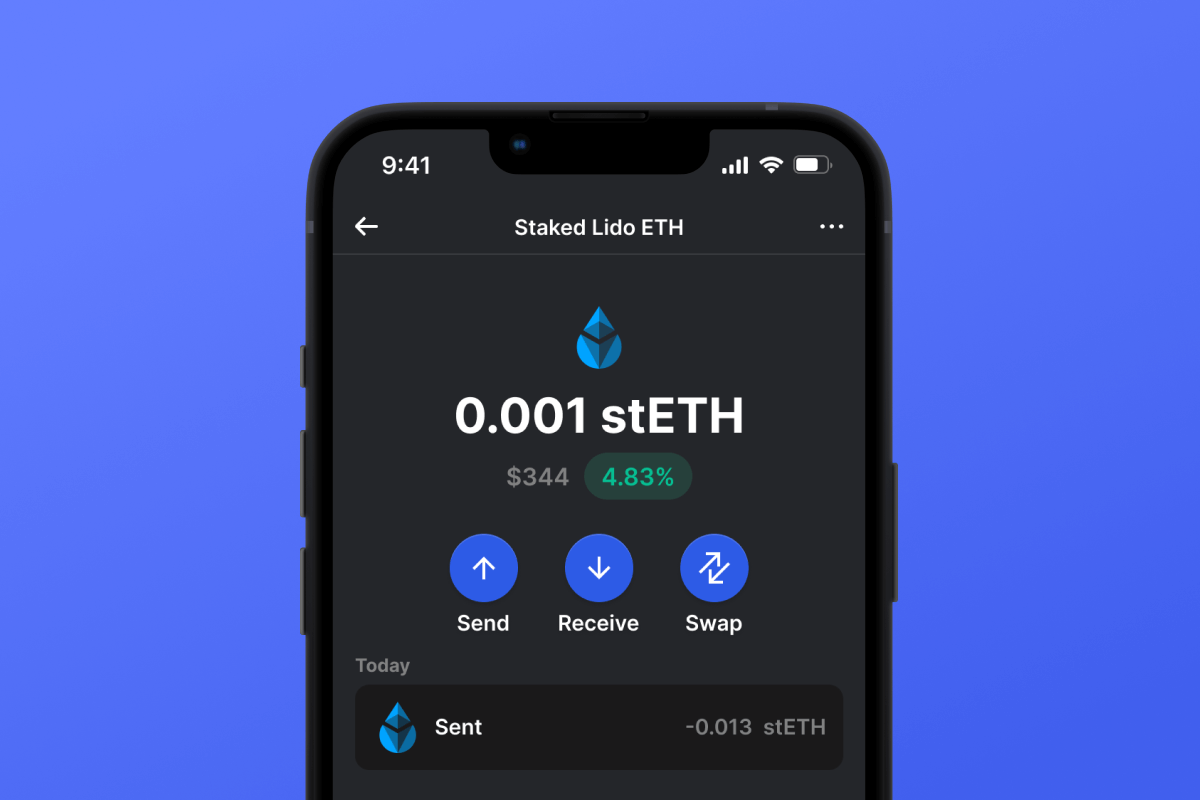

Den aktuellen Preis von Staked Lido ETH (stETH) finden Sie in Ihrem Gem Wallet.

Ist stETH eine gute Investition?

Obwohl stETH die Möglichkeit bietet, Staking-Belohnungen zu verdienen und Liquidität aufrechtzuerhalten, sollte die Investitionsentscheidung auf persönlicher Recherche, Risikobereitschaft und finanziellen Umständen beruhen.

Wie funktioniert Staked Lido ETH (stETH)?

Staked Lido ETH (stETH) fungiert als Teil des Staking-Mechanismus des Ethereum 2.0-Netzwerks. Wenn Sie Ihr ETH bei Lido staken, erhalten Sie im Gegenzug eine entsprechende Menge an stETH-Token. Diese Token repräsentieren Ihr gestaktes ETH plus alle durch das Staking verdienten Belohnungen. Der innovative Aspekt von stETH besteht darin, dass es liquide ist, d. h. es kann gehandelt, übertragen oder in DeFi-Anwendungen verwendet werden, während es weiterhin Staking-Belohnungen einbringt.

Wichtige Aspekte von stETH sind:

- Staking: Benutzer staken ETH bei Lido und erhalten im Gegenzug stETH.

- Belohnungen: Der Bestand an stETH-Token wächst automatisch, wenn Staking-Belohnungen anfallen.

- Liquidität: stETH-Token können gehandelt oder in DeFi-Protokollen verwendet werden und bieten Liquidität, die beim herkömmlichen Staking nicht verfügbar ist.

- Dezentralisierung: Lido verwendet ein dezentrales Netzwerk von Knotenbetreibern zum Staking, was Sicherheit und Vertrauen verbessert.

Was sind Liquid Staking Derivatives (LSDs)?

Liquid Staking Derivatives (LSDs) stellen die eingesetzten Vermögenswerte eines Benutzers in einem Blockchain-Protokoll dar. Wenn Benutzer beispielsweise ihr Ethereum (ETH) bei einem Liquid-Staking-Anbieter einsetzen, erhalten sie ein LSD, einen Quittungstoken. Dieses Token ähnelt den meisten anderen Kryptowährungstoken darin, dass es vollständig fungibel, übertragbar und fraktional ist.

LSDs geben im Wesentlichen die Liquidität des eingesetzten ETH frei, das vorübergehend gesperrt ist. Das LSD hat einen ähnlichen Wert wie das zugrunde liegende eingesetzte ETH und ermöglicht es Benutzern, ihr eingesetztes ETH indirekt in DeFi-Aktivitäten zu verwenden. Diese Aktivitäten könnten den Verkauf des LSD, seine Bereitstellung als Liquidität in einem Pool, sein Verleihen oder seine Verwendung als Sicherheit für ein Darlehen umfassen. Dieser Prozess ermöglicht es Benutzern, zusätzlich zu ihren Staking-Belohnungen zusätzliche Rendite zu erzielen.

Es gibt verschiedene Anbieter, die Liquid-Staking-Derivate anbieten, darunter:

- Lido Finance (LDO): Lido ist ein führendes Unternehmen im Bereich Liquid Staking. Benutzer zahlen ETH ein und erhalten stETH, einen Quittungstoken, der ihr eingesetztes ETH repräsentiert. Lido erhält eine Provision von 10 % auf die Staking-Belohnungen. Das Unternehmen hat auch eine verpackte Version von stETH namens wstETH eingeführt, deren Wert mit der Zeit steigt, anstatt den Kontostand zu erhöhen. Zum Zeitpunkt der Veröffentlichung des Artikels hatte Lido einen Gesamtwert von ca. 7,2 Milliarden USD in eingesetztem ETH und erzielte einen Jahresumsatz von über 32 Mio. USD.

- Rocket Pool (RPL): Rocket Pool ist nach Lido eines der größten ETH-Liquid-Staking-Protokolle und konzentriert sich auf Dezentralisierung. Benutzer setzen mindestens 16 ETH und 1,6 ETH im Wert von RPL, dem Governance-Token von Rocket Pool, ein, um Knotenbetreiber zu werden. Staker erhalten bei der Einzahlung rETH, das einen ähnlichen Wert wie wstETH ansammelt. Rocket Pool nimmt eine Gebühr von 5–20 % der Staking-Belohnungen und gibt diese vollständig direkt an die Knotenbetreiber weiter.

- Frax Finance: Frax Finance hat einen ETH-Liquid-Staking-Dienst eingeführt, der ETH in frxETH, ein ETH-LSD, umwandelt. Bis Januar 2023 war das eingesetzte ETH von Frax Finance um 40 % gestiegen, was ein signifikantes prozentuales Wachstum im Vergleich zu anderen LSD-Protokollen darstellt und damit seine Position als einer der führenden Liquid-Staking-Anbieter behauptet.

TIA

TIA  SEI

SEI  ATOM

ATOM  APT

APT  INJ

INJ  SOL

SOL  OSMO

OSMO  SUI

SUI  TRON

TRON  ETH

ETH  HYPE

HYPE  BNB

BNB  TON

TON  RON

RON  FTM

FTM  MATIC

MATIC